Volume 11, Number 2, February 2015

Pre-EDGAR index to SEC filings back to 1967 now available on RBsourceFilings

RBsourceFilings now contains the complete index to SEC filings dating back to 1967. Filings prior to 1994 are predominantly in print and therefore not viewable in RBsourceFilings. However, subscribers can now search for and locate references to these documents on RBsourceFilings and order documents, for an additional fee, by contacting the Wolters Kluwer Research Department at 1-800-955-5219.

Free Special Report: 2014 Securities Industry Year in Review by Jim Hamilton

The year 2014 saw the continuing implementation of the Dodd-Frank Act by the SEC and other federal regulators, a very important U.S. Supreme Court ruling construing the fraud-on-the-market doctrine, and several Dodd-Frank technical corrections addressed by the 113th Congress.

Click here to download the 2014 Securities Industry Year in Review Strategic Perspective and catch up on summaries of major decisions that can affect your clients or organization, including:

Regulatory Action—Credit Risk Retention, Credit Rating Agencies, Money Market Funds

Judicial Action—Fraud-on-the-Market, Scope of Sarbanes-Oxley, Whistleblower Provision, Insider Trading

Legislative Action— Dodd Frank Amendments regarding Loan Collateral and Risk Mitigation

For the latest in securities regulation news and updates, check out the Wolters Kluwer Securities Regulation Daily in 2015. For more information on how to start receiving your daily updates, visit www.dailyreportingsuite.com/securities.

This new blog offers:

- Insight and analysis on international tax law

- Expert analysis written by leading international tax experts from different backgrounds

- A fast and easy medium for quickly reading articles that provide a timely examination of the world of international taxation

- Opinions rather than mere reports of new developments, with insight into complex matters

Key features:

- Global coverage providing short posts focused on international tax law and relevant developments in national law

- Reports on selected case law, legislative developments, new publications, political developments and strategic tax aspects

- Analysis of legal developments and general practice on core topics such as tax treaties, permanent establishments, transfer pricing, BEPS, tax planning, compliance, wealth management, and VAT

Access the blog at www.kluwertaxlawblog.com.

New Book: Permanent Establishments. Domestic Taxation, Bilateral Tax Treaty and OECD Perspective, Fourth Revised Edition

This new volume provides comprehensive guidance on a variety of complex PE issues. Initial chapters analyze the latest OECD developments within the context of Articles 5 and 7 of the OECD Model Tax Convention (2014 update), while 20 country chapters cover domestic PE issues as well as country-specific treaty developments from a practical perspective.

Countries covered include: Australia, Austria, Belgium, China, Denmark, Estonia, France, Germany, Hungary, India, Italy, Japan, The Netherlands, Russia, Spain, South Africa, Sweden, Switzerland, United Kingdom, and the United States.

Click here for more information and to order.

New book: The Code of the Court of Arbitration for Sport (CAS)

The Court of Arbitration for Sport (CAS)provides international sport with an independent authority specializing in sports-related disputes. This book covers topics such as:

- How to validly establish CAS jurisdiction

- How to draft valid requests for arbitration and statements of appeal

- What is the law applicable to CAS proceedings

- What type of provisional measures can be ordered by CAS

All significant cases regarding contractual issues, eligibility and disciplinary matters, governance issues and other types of disputes typically arising in the world of sport are treated in depth as they arise under the relevant provisions.

Click here for more information and to order.

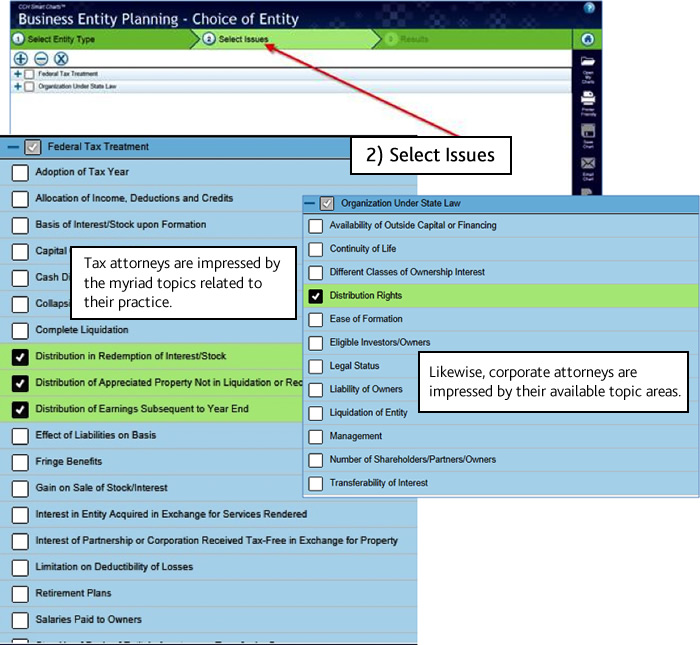

Question: Is there an IntelliConnect Smart Chart that can assist me in choosing a business entity?

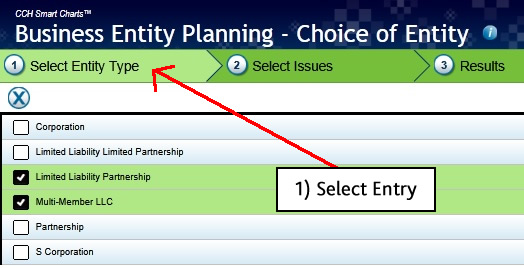

Answer: Yes, one of the most helpful tools on IntelliConnect is the Choice of Entity Smart Charts. Both Corporate and Tax Attorneys can help their clients decide what kind of entity they would like to form. In just three clicks they can find out the tax ramifications and/or governing business organization law for each entity being considered.

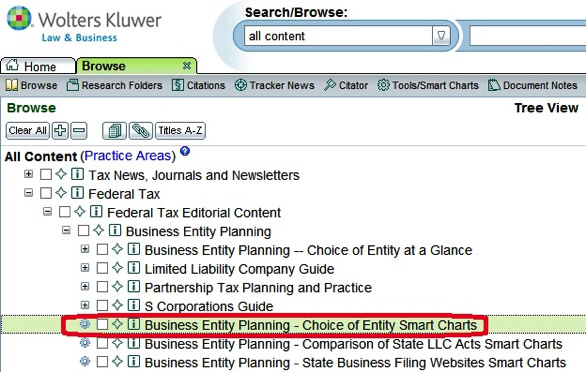

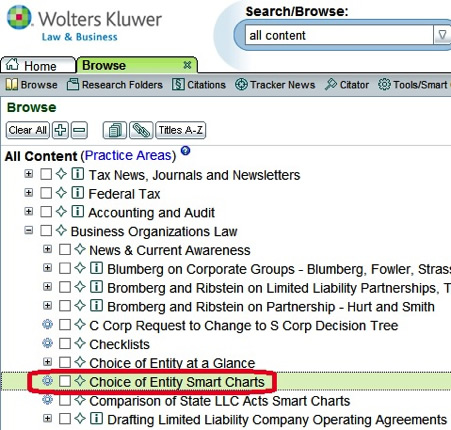

Depending upon your subscription, you can find Choice of Entity Smart Charts in either of the following locations within IntelliConnect:

Federal Tax Editorial Content

Business Organizations Law

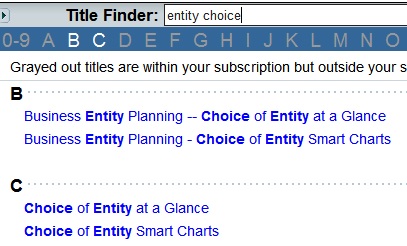

Both can be found quickly by using the Titles A-Z tool  to look up entity choice . . .

to look up entity choice . . .

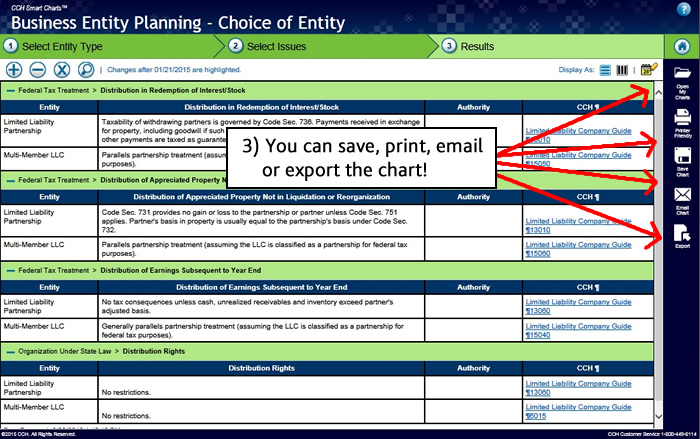

...in just three steps:

And for the attorney who just wants to give a broad overview for all necessary topics, whether tax or corporate, they can provide a snapshot to the client in seconds:

Launch our LegalPro Training calendar webpage and register for any of our complimentary pre-scheduled instructor-led sessions offered for a wide variety of our online products, OR use the links below to access a schedule for a specific online platform/product:

- IntelliConnect * - available for all content within IntelliConnect as well as subscriptions for Health Reform Knowledge Center, WK Trademark Navigator, General Counsel Navigator, and Kluwer International Tax Law.

- LoislawConnect *

- RBsource (new platform, hands-on training)

- RBsource Transition (new platform, presentation of enhancements)

- RBsourceFilings

- Kluwer services (including Kluwer IP Law, Kluwer Arbitration and Kluwer Competition Law)

*IntelliConnect and LoislawConnect registrations are limited to a single person so that each session can be customized to that individual’s subscription and research needs. However, registrants are welcome to share webinar connection details with others in their organization.

Or email a training request to us via LegalProTraining@wolterskluwer.com

Review our Training Resources for Legal Professionals website—http://wolterskluwerlb.com/training—to find helpful links to videos, training guides and quick reference material for a wide variety of our Platforms/Applications and products.

IntelliConnect and RBsource subscriptions

CHAT: http://support.cch.com/chat/techsupport (available 8 am to 6 pm CT Monday-Friday)

CALL: (available 8 am to 8 pm CT Monday-Friday)

Research & Functionality: 1-800-344-3734 option #1 (IntelliConnect) or option #3 (Other inquiries)

Technical Support: 1-800-835-0105 option #1 (IntelliForms) or option #2 (All other inquiries)

EMAIL: customerservice@wolterskluwer.com

LoislawConnect and Kluwer Law International subscriptions

CLICK: estore.loislaw.com

EMAIL: supportservices@loislaw.com (available 3 am to 10 pm CT Monday-Friday)

CALL: 1-877-471-5632 (available 8 am to 8 pm CT Monday - Friday)

SECnet and IPO Vital Signs

CALL: 1-800-955-5219 (toll-free) or 1-202-842-7355 (toll)