|

|

|

|

April 2012 |

|

From the editors of CCH Federal Securities Law Reporter, CCH Blue Sky Law Reporter and the securities publications of Aspen Publishers, this update describes important developments covered in these publications, as well as timely topics of interest generally to federal and state securities practitioners. This update includes a preview of IPO Vital Signs, an advanced IPO research analysis tool, for IPO professionals and pre-IPO companies. New this month is a preview of RBsource, an all-in-one online securities law resource, powered by the Securities Redbook. Finally, please see the “Hot Topic of the Month,” for research tips and references to CCH and Aspen source material on point.

To view past issues of the Securities Update, please visit http://business.cch.com/updates/securities.

If you have questions or comments concerning the information provided below, please contact me at rodney.tonkovic@wolterskluwer.com.

Financial Reform Resources

CCH Federal Securities Law Reporter

SEC and CFTC Propose Identity Theft Red Flags Rules. The SEC and the CFTC have jointly issued proposed rules and guidelines to implement new statutory provisions enacted by Title X of the Dodd-Frank Act amending Section 615(e) of the Fair Credit Reporting Act to address identity theft. The SEC is proposing to add a new subpart, "Regulation S-ID: Identity Theft Red Flags") to its regulations under the Fair Credit Reporting Act. The proposed rules and guidelines would require "financial institutions and creditors," as defined by the FCRA, to develop and implement a written identity theft prevention program reasonably designed to detect, prevent, and mitigate identity theft in connection with certain existing accounts or the opening of new accounts. The SEC's rules and guidelines would apply to registered brokers, dealers, investment companies, and investment advisers. The proposed rules would also establish special requirements for any credit and debit card issuers to assess the validity of notifications of changes of address under certain circumstances, such as requests for replacement cards shortly after a notification is received. Release No. IC-29969 is reported at ¶89,716.

Supreme Court Rejects Section 16(b) Tolling Based Solely on Failure to File Insider Disclosures. The U.S. Supreme Court held in a unanimous decision (Chief Justice Roberts did not participate in the case) that in a Section 16(b) case, equitable tolling ceases when fraudulently concealed facts are, or should have been, discovered by the plaintiff. The court rejected the claim by the plaintiff that the statute’s two-year limitations period was tolled by the failure to make Section 16(a) filings even if the plaintiff was aware of the potential claim.

In an opinion authored by Justice Scalia, the court stated that“[u]nder long-settled equitable tolling principles, a litigant must establish (1) that he has been pursuing his rights diligently, and (2) that some extraordinary circumstances stood in his way. Allowing tolling to continue beyond that point would be inequitable and inconsistent with the general purpose of statutes of limitations, concluded the court.

This case presented a novel application of Section 16(b). Unlike most cases which involve management or large investors in public companies, this case involved underwriters. As described by Justice Scalia, this theory of liability is “so novel that petitioners can plausibly claim that they were not aware they had to file a §16(a) statement," and “would be compelled either to file or to face the prospect of §16(b) litigation in perpetuity."

The decision reflects the view of the SEC, as expressed in a brief that supported neither party. The Commission urged the court to recognize equitable tolling in Section 16 cases, but did not support the extension of such tolling in cases based on failure to file insider reports where the plaintiff had knowledge of the claim. Credit Suisse Securities (USA) LLC v. Simmonds (US Sup Ct) is reported at ¶96,764.

2nd Circuit Interprets “Morrison” Standard. The 2nd U.S. Circuit Court of Appeals discussed the Supreme Court's decision on the extraterritorial application of the securities laws. A group of hedge funds based in the Cayman Islands alleged that an investment manager caused them to purchase at inflated prices penny stocks in a pump-and-dump scheme. The district court found that it lacked federal subject matter jurisdiction over the plaintiff's claims and dismissed the complaint in its entirety. The court explained that the case involved foreign investors suing foreign and domestic defendants, and there was no sale of a security listed on an American exchange and no transaction occurring in the United States.

The panel determined that the district court's dismissal of the complaint for lack of subject matter jurisdiction was in error. At issue was whether the foreign funds' purchases and sales of securities issued by U.S. companies and brokered through a U.S. broker-dealer constituted "domestic transactions" under Morrison v. National Australia Bank. In Morrison, the Supreme Court held that Exchange Act Section 10(b) applies only to "transactions in securities listed on domestic exchanges" and "domestic transactions in other securities." The panel remarked, however, that the Court in Morrison provided little guidance as to what constitutes a domestic purchase or sale.

The panel held that in order to sufficiently allege the existence of a "domestic transaction in other securities," plaintiffs must allege facts suggesting that either irrevocable liability was incurred or that title transferred within the United States. In this instance, however, the appellate court noted that the complaint failed to state a claim under Section 10(b) because it did not sufficiently allege that purchases or sales took place in the United States. The panel concluded that "due to the significant ambiguity as to what constitutes a "domestic transaction in other securities,"" the plaintiffs should be given leave to amend the complaint to assert additional facts suggesting that irrevocable liability was incurred or title passed in the United States and to show that the securities transactions at issue took place in the United States. Absolute Activist Value Master Fund Limited v. Ficeto (2ndCir) is reported at ¶96,745.

Uniform Standards Act Did Not Apply to Brokerage Fee Claims. The 7th Circuit held that the Securities Litigation Uniform Standards Act did not apply to a putative class action against Morgan Stanley Dean Witter seeking the recovery of handling fees associated with securities transaction confirmations. The firm entered into agreements with its customers that set a fee for handling, postage, and insurance (HPI) for mailing trade confirmation slips after each purchase or sale of securities. The suit claimed that the fees charged bore no relationship and were grossly disproportionate to Morgan Stanley's actual transaction costs.

According to the 7th Circuit panel, the Uniform Standards Act did not apply because any alleged misrepresentation that the stated HPI fee was tied to actual costs was not material to investor decisions to buy or sell securities. Quoting an earlier 2nd Circuit decision on similar facts, the court stated that "no reasonable investor would have considered it important, in deciding whether or not to buy or sell stock, that a transaction fee of a few dollars might exceed the broker’s actual handling charges." The confirmation slips set forth the fee amount and the plaintiffs were not charged more than the amounts reported on these slips. As quoted by the court, "if brokerage firms are slightly inflating the cost of their transaction fees, the remedy is competition among the firms in the labeling and pricing of their services, not resort to the securities fraud provisions."

The court found, however, that Morgan Stanley met its burden of showing that the Class Action Fairness Act's general jurisdictional requirements were met, and the plaintiff did not show that the securities exception to CAFA jurisdiction applied. The court affirmed the district court's order dismissing the complaint. The language in the agreement did not suggest that the HPI fee represented Morgan Stanley's actual costs, stated the court, and it was not reasonable to read this into the agreement. Morgan Stanley also had no implied duty under applicable New York law to charge a fee that was reasonably proportionate to actual costs where it notified customers in advance of the charges and customers were free to decide whether to continue to do business with Morgan Stanley. Appert v. Morgan Stanley Dean Witter, Inc. (7thCir) is reported at ¶96,750.

1st Circuit Panel Finds No Evidence of “Anything Close to Fraud.” A 1st Circuit panel affirmed a district court's grant of summary judgment in favor of the parent company of a firearms manufacturer. A class of purchasers of the holding company's securities alleged that the company and two of its officers issued false and misleading statements about the demand for its products. According to the complaint, the company had reported strong performance and issued high sales numbers and optimistic earnings projections during the class period. The sales numbers for that time, however, had been artificially inflated through unusual promotions and discounting that pulled revenue from future quarters. The stock price fell after the company released unfavorable preliminary earnings data and revised its earnings projections downward, citing inventory buildup and low retail traffic as factors.

The district court granted the company's motion for summary judgment after finding that the investors failed to plead that there were misrepresentations or scienter. The panel affirmed, concluding that there was "no evidence of anything close to fraud." The investors contended that the company knew demand was weakening when it reported strong sales numbers and pointed to inventory reports, internal order tracking data, and promotions and discounts as evidence of declining demand that should have been disclosed in the statements. The panel, however, found the evidence to be "razor thin" and of limited significance. For example, the panel observed that three of the sales targets were missed by less than 5 percent, and the investors did not mention other sales targets that were exceeded by 46 percent during the same period. Regarding the discounts, the panel noted that using discounts to stimulate sales is not automatically manipulative, and, in this case, the conduct was not shown to be unusual or to represent a significant percentage of reported sales.

The panel then found no proof of scienter in the company's failure to disclose a documented fall in sales during the class period. Even if the numbers should have been disclosed, the panel found no evidence of subjective bad intent or misstatements that were so blatantly improper that recklessness could be inferred. According to the panel, the failure to disclose the drop in sales was a negligent misjudgment, and there was no evidence that would raise an inference of culpable recklessness. Once the downward trend became clear, the panel remarked, the company acknowledged that its earlier forecasts had been undermined. In re Smith & Wesson Holding Corp. Securities Litigation (1stCir) is reported at ¶96,742.

CCH Blue Sky Law Reporter

Georgia Proposes Clarifications to Recently Adopted Securities Rules. Clarifications to some of the rules adopted on December 8, 2011 to conform them to the Georgia Uniform Securities Act of 2008 were proposed by the Georgia Office of the Secretary of State. The proposed rule changes include the following: (1) The new non-profit organization securities exemption would mandate that NASAA’s Church Bond and Church Extension Fund Policy Statements be applied to offerings made under the exemption. (2) The filing date for Georgia’s limited offering exemption corresponding to Rule 505 of federal Regulation D would be changed to 15 business days after the receipt of consideration or the delivery of a subscription agreement; (3) The new Invest Georgia exemption would be available only to for-profit business entities; (4) The "electronic filing with designated entity" and "application renewal" rules for investment advisers and investment adviser representatives would eliminate the "grace period" for filings due each December; and (5) Investment adviser contract, written exam, recordkeeping and supervision rules would clarify that these rules apply only to investment advisers or investment adviser representatives registered or required to register in Georgia. ¶18,415, ¶18,419, ¶18,420, ¶18,434, and ¶18,441.

Illiniois Replaces NASD References with FINRA. References to the Financial Industry Regulatory Authority (FINRA) replace existing references to the National Association of Securities Dealers (NASD) throughout the Illinois securities rules, to reflect the official name of the organization that now regulates broker-dealers and investment advisers. Other adopted changes by the Illinois Securities Department include restating that the CRD, not the IARD, is the electronic database for receiving investment adviser representative filings and fees; specifying that new and re-registration applications for investment advisers or IA branch offices, along with re-registrations for investment adviser representatives and re-notifications for federal covered investment advisers, annually expire at the end of the day on December 31; amending the language of the grandfathering provision of the exam requirement for investment adviser principals and representatives, from “on the effective date of this section” to “on May 1, 2000,” replacing legalese, e.g., “hereunder,” “such,” and “which,” with plain English, e.g., “the” or “that,” and substituting current terms or dates for outdated references. ¶22,613 through ¶22,693.

Kentucky Proposes Adding Inspection Fees for IAs with AUM Exceeding $20 Million and for Firms Employing Issuer-Agents. Fees for the Kentucky Department of Financial Institutions’ staff to examine investment advisers with assets under management above $20 million were proposed to cover the higher threshold advisers that will be subject to state rather than federal regulation in light of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Investment advisers (IAs) with assets under management (AUM) of between $20 and $30 million would pay $350; IAs with AUM of between $30 and $45 million would pay $450; IAs with AUM of between $45 and $60 million would pay $550; IAs with AUM of between $60 and $75 million would pay $650; and IAs with AUM exceeding $75 million would pay $750. Another proposed amendment would apply the fee for examining broker-dealer firms, $35 per working hour up to a total maximum fee of $1,000, to firms that employ issuer-agents. ¶27,430.

Maine Order Sets Forth Private Fund Adviser Exemption. An exemption from investment adviser registration for private fund advisers was set forth by administrative order of the Maine Office of Securities. ¶29,572.

Massachusetts Adopts Private Fund Adviser Exemption. A private fund adviser exemption was adopted by the Massachusetts Securities Division, along with amendments to the “qualified institutional buyer” definition and IA custody/discretionary authority requirements. The rule adoptions will be enforced beginning on August 3, 2012. ¶31,455.

Virginia Proposes Exemption for Private Fund Advisers. An exemption from investment adviser registration was proposed for private fund advisers by the Virginia Division of Securities and Retail Franchising. The exemption, anticipated for adoption May 1, 2012, would replace a currently effective extension of a de minimis exemption. Interested persons may submit written comments about the proposed rule to Joel H. Peck, Clerk of the Commission, c/o Document Control Center, P.O. Box 2118, Richmond, Virginia 23218, on or before April 12, 2012. ¶60,458YA.

Washington State Proposes Amending “Accredited Investor” Definition in Its Regulation D Exemption. The definition of an accredited investor in Washington State’s Regulation D exemption includes, among the listed entities and persons, any natural person whose individual net worth, or joint net worth with that person’s spouse, at the time of the purchase exceeds $1 million, excluding the value of the primary residence of such natural person. The Washington Department of Financial Institutions, by expedited rule making, proposed to replace “excluding the value of the primary residence of such natural person” with a more fleshed-out exception to the net worth calculation that factors in the amount of indebtedness on the primary residence up to its estimated fair market value and sets forth the instances when indebtedness is and is not included as a liability in the net worth calculation. Also, the statutory references in various definition rules were proposed for update. Please send written comments about the proposed amendment to Michelle Webster, Staff Attorney, at the Department of Financial Institutions, Securities Division, P.O. Box 9033, Olympia, Washington 98507-9033. ¶61,534G, ¶61,616BB, ¶61,621L, ¶61,622B, ¶61,701, ¶61,701A, and ¶61,752.

Wisconsin Sets Forth Private Fund Adviser Exemption by Administrative Order. Private fund advisers are exempt from Wisconsin investment adviser registration requirements if neither the advisers nor their advisory affiliates are subject to “bad boy” disqualification provisions under Rule 262 of federal Regulation A, and the advisers electronically file through the IARD the SEC-filed reports and amendments required for exempt reporting advisers by Rule 204-4 of the Investment Advisers Act of 1940. Private fund advisers in business on February 17, 2012 must make their initial filings no later than March 30, 2012. A report is “filed” when the SEC-filed reports and amendments are submitted to, and accepted by, the IARD on the State’s behalf, assuming the exemption’s other conditions are met. ¶64,994G.

Seller Could Reasonably Rely On Corporation’s Representation of “Accredited Investor” Status. A federal district court (N.D. Ind.) has held that a corporation that acquired another corporation's subsidiaries in exchange for stock could reasonably rely on the selling firm's representation that it was an "accredited investor" for purposes of claiming a private placement exemption under the former Indiana Securities Act (Act) . In Supernova Systems, Inc. v. Great American Broadband, Inc., the plaintiff alleged that the defendant had violated the registration requirements of the Act by failing to register the shares of the common stock that it provided to the plaintiff in exchange for its purchase of all of the stock of the plaintiff's five subsidiaries. The court concluded that the defendant's sale of unregistered shares was lawful, however, because it fell under the Act's "private placement" exemption involving sales to a limited number of "accredited investors."

Although neither the plaintiff nor its shareholders possessed the necessary assets for accredited investor status, the plaintiff's representation in the subscription agreement that it was an accredited investor was, under the particular circumstances of the transaction, sufficient to cause the defendant to reasonably believe that the plaintiff was an accredited investor. The court noted that the parties had engaged in a sophisticated transaction requiring several months of negotiation and were both represented by counsel. Moreover, there was no indication that the individuals who negotiated the transaction and signed the stock purchase agreement on behalf of the plaintiff had given the defendant any reason to know or suspect the plaintiff was not an accredited investor through the financial worth of its shareholders. Accordingly, the court held that the transaction was exempt from the registration requirements of the Act as a matter of law. Supernova Systems, Inc. v. Great American Broadband, Inc. will be reported at ¶74,969.

Aspen Federal Securities Publications

Raising Capital: Private Placement Forms & Techniques, Third Edition, by J. Robert Brown, Jr., The Late Herbert B. Max. The 2012 Supplement is now available online. This unique resource provides practice-tested forms and up-to-date expert guidance for successfully launching private placement investment transactions. The authors illustrate a variety of proven techniques for raising capital and explain ways to accommodate the investor’s demands for protection while maintaining the flexibility necessary for efficient operation and growth in today’s business and regulatory environment. This latest update features expanded coverage and analysis regarding Subscription Agreements (Chapter 8). The entire chapter has been updated and contains numerous sample subscription agreements, accredited investor questionnaires, and related representations, covenants and provisions. The chapter on Preferred Shares (Chapter 10) has been updated and contains numerous charter and other provisions, and sample certificates of designation relating to preferred shares. In addition, the chapter on Exemptions from Registration Under the Securities Laws: Regulation D (Chapter 19) is expanded and certain forms have been further updated to reflect a change to the accredited investor standard in Section 413 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

Financial Reporting Handbook, by Michael Young. The latest release, Release 34, is available online. This reference provides quick access to critical aspects of financial reporting. In addition to covering the Sarbanes-Oxley Act, SEC rules and regulations, standards of the Independence Standards Board and the AICPA and requirements of the New York Stock Exchange, NASDAQ, and the American Stock Exchange,the Financial Reporting Handbook tackles important underlying themes such as the centrality of the audit committee, the individual responsibility of executives, and the integrity of the outside auditor.

IPO Vital Signs

IPO Vital Signs, an advanced IPO research analysis tool, assists IPO professionals and pre-IPO companies satisfy their most challenging research needs and answers hundreds of mission critical questions for all the players in the IPO process. IPO Vital Signs’ tabular data analyses focus on issues surrounding client advisement, deal negotiation, and prospectus disclosure.

IPO Week in Review, a weekly e-newsletter to keep professionals up to date with recent filing and going public activity, is an important element of the IPO Vital Signs system or is available by separate subscription. Coverage includes a monthly feature article on recent trends in going public in the U.S.

To see how an IPO Vital Sign works click on the Vital Sign title below:

![]()

Free Preview!>> |

#324 – SIC Codes

|

Tip! Click on blue numbers to drill down for more information. Select a number of issuers’ final prospectus business descriptions by clicking in boxes of those you wish to review in the third column (placing a check-mark in each box), and clicking the [COMPARE] button at the top of the fourth column.

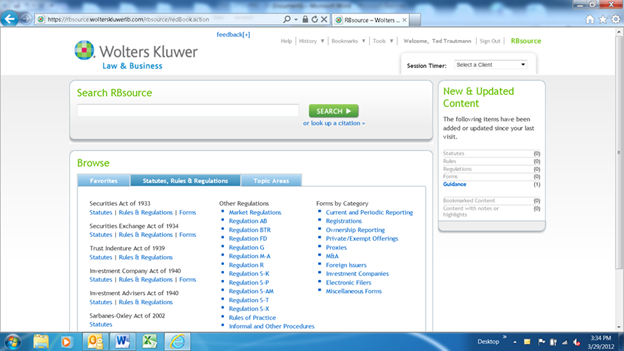

RBsource

A new research tool powered by the Securities Redbook (Securities Act Handbook), RBsource offers you securities laws, rules, regulation and forms together with related SEC guidance and interpretations. With RBsource, you will have SEC guidance related to a specific law, regulation or rule at your fingertips without the need of further searching or browsing. RBsource uniquely associates related content, going beyond the limits of standard searching making research more streamlined and productive. This intuitive research tool will drastically reduce your research time and provide the unparalleled confidence expected from the trusted Securities Act Handbook.

Legislative Developments

Congress has passed the STOCK Act and the JOBS Act. RBSource will update affected law sections as soon as both acts have been signed by the president. A statement by the White House press secretary indicated that separate signing ceremonies will be held at the White House during the week of April 2, 2012.

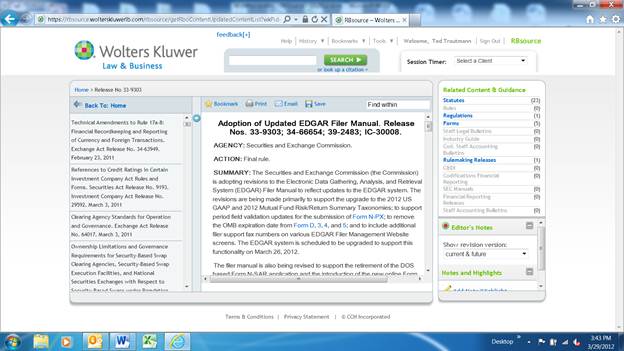

Recently added SEC rulemaking releases

- 33-9303 Adoption of Updated EDGAR Filer Manual (March 26, 2012).

- 33-9287A Net Worth Standard for Accredited Investors (Technical amendment) (March 23, 2012).

- 34-66502 Rules of Organization; Conduct and Ethics; and Information and Requests (March 7, 2012).

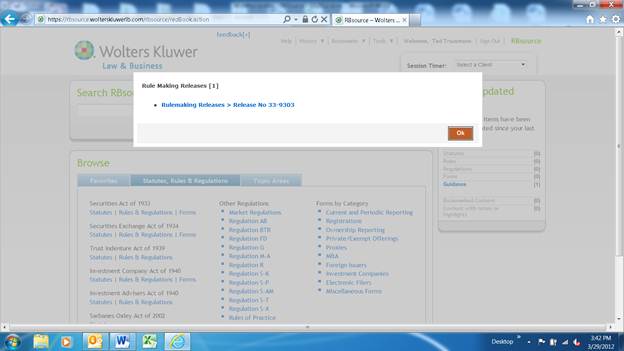

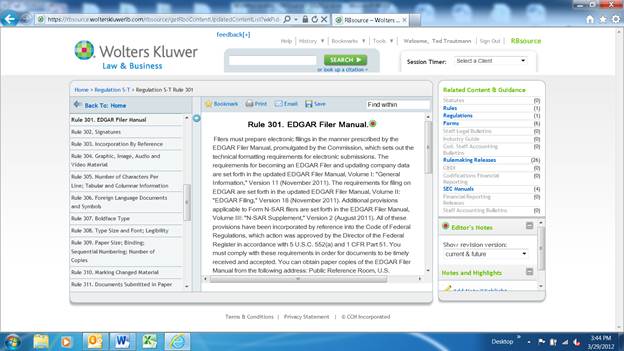

Search Tip: Using the New and Updated Content feature to track amended regulations

1. Click on “Guidance” under New and Updated Content.

2. Select the relevant rulemaking release.

3. Scroll through and read relevant portions of the full text of the rulemaking release.

4.Under Related Content and Guidance, click on “Regulations.”

5. Select the applicable rule discussed in the rulemaking release.

6. View the text of the amended rule along with links to related rules in the left navigation pane, Related Content and Guidance in the right navigation pane, plus Editor’s Notes and Notes and Highlights tools.

This month's hot topic is the Foreign Corrupt Practices Act ("FCPA"). Exchange Act Section 30A, which was added to the Exchange Act by the Foreign Corrupt Practices Act of 1977, establishes prohibitions with respect to certain foreign corrupt practices. Issuers having a class of securities registered under Section 12 of the Exchange Act or subject to Exchange Act reporting under Section 15(d), the officers, directors, employees and agents of such an issuer, and stockholders acting on behalf of such an issuer are subject to the prohibitions of Section 30A. The Act makes it unlawful for issuers and other persons to corruptly use interstate means, i.e., the mails or a means or instrumentality of interstate commerce, "in furtherance of" an offer, payment, promise to pay or authorization for the payment of money to certain foreign entities for described purposes. The law is applicable not only where money is being paid, but also in the case of the giving of anything of value.

The offer, promise, or payment of money is prohibited if made to a foreign official or a foreign political party, an official thereof, or a candidate for foreign political office and there is a purpose of seeking the use of influence in order to assist the issuer in obtaining or retaining business for or with a person, or directing business to a person. The term "foreign official" refers to any officer or employee of a foreign government, or any department, agency, or instrumentality thereof; it refers to any person acting in an official capacity for or on behalf of any such person or entity.

Lawfulness of the payment, gift, offer or promise under the written law and regulations of the foreign country is an affirmative defense. An affirmative defense is also available for reasonable and bona fide expenditures incurred in activities such as the promotion, demonstration or explanation of products or services or the execution or performance of a contract with a foreign government or agency. Issuers who violate Section 30A can be fined up to $2 million. Officers, directors, stockholders acting on an issuer's behalf, and employees and agents of an issuer may be fined up to $100,000, imprisoned for up to five years, or both.

We publish related information in a wide range of resources (e.g., Federal Securities Law Reporter, SEC Today, etc.), and document types (laws, regulations, releases, newsletter articles, treatise discussion, Insights – Amy L. Goodman, etc.). For example:

- Federal Securities Law Reporter

- Exchange Act Section 30A at ¶26,625

- Exchange Act Section 32(c) at ¶26,642

- Release No. 34-17099 at ¶26,628

- Release No. 34-18255 at ¶26,629

- U.S. v. Aguilar (CD Cal) is reported at ¶96,721

- "In the Matter of Watts Water Technologies, Inc. and Leesen Chang," Release No. 34-65555, at ¶89,630

- CCH Explanations (e.g. "Foreign Corrupt Trade Practices" at¶26,630)

- Report letters (e.g., 2-15-12, "Panelists Discuss FCPA Enforcement and Investigations" and 2-1-12, "Securities Litigation 2011: A Look Back")

- SEC Today "SEC Historical Society Panel Discusses Developments in FCPA" (April 21, 2010)

- Securities Regulation – Loss, Seligman & Paredes (e.g. Chapter 2.D.3.a)

- U.S. Regulation of the International Securities and Derivatives Markets – Greene, Beller, Rosen, Silverman, Braverman, Sperber and Grabar (e.g., Chapter 4.09)

- SEC Topic Navigator