|

|

|

|

June 2012 |

|

From the editors of CCH Federal Securities Law Reporter, CCH Blue Sky Law Reporter and the securities publications of Aspen Publishers, this update describes important developments covered in these publications, as well as timely topics of interest generally to federal and state securities practitioners. This update includes a preview of IPO Vital Signs, an advanced IPO research analysis tool, for IPO professionals and pre-IPO companies. New this month is a preview of RBsource, an all-in-one online securities law resource, powered by the Securities Redbook. Finally, please see the “Hot Topic of the Month,” for research tips and references to CCH and Aspen source material on point.

To view past issues of the Securities Update, please visit http://business.cch.com/updates/securities.

If you have questions or comments concerning the information provided below, please contact me at rodney.tonkovic@wolterskluwer.com.

Financial Reform Resources

CCH Federal Securities Law Reporter

7th Circuit Panel Affirms District Court’s Scienter Holding. A district court’s dismissal of a complaint due to failure to meet the PSLRA pleading standards was affirmed by a 7th Circuit panel. Two pension funds claimed that a manufacturer of medical devices defrauded investors by downplaying the significance of quality control problems at its plant and the high failure rate reported by one surgeon for one of its products. The complaint alleged that the company issued materially false earnings guidance that did not fully take into account the significance of the quality control problems. The complaint also alleged that the company claimed that the failure rate encountered by the surgeon was due to improper surgical technique when the problem actually stemmed from poor design and quality control. The district court found that the complaint failed to meet the pleading standard for scienter.

The panel agreed with the district court’s conclusion that the investors failed to plead facts giving rise to a strong inference of scienter. The investors argued that, given the conflict between the company and the surgeon, a jury could infer that the company was lying about the high failure rate. According to the panel, however, the investors failed to provide a cogent reason showing that the company’s statements were false, let alone knowingly false. The panel observed that European surgeons had been using the identical product for several years prior to its introduction in the U.S., and that they had a much lower failure rate. The complaint, the panel continued, did not establish an inference of fraudulent intent as compelling as the inference that the company simply believed that the different failure rates encountered in Europe and by the American surgeon were caused by differences in how the device was implanted. The court also noted that the FDA never issued any warnings or cautions about the product.

Regarding the alleged quality-control problems at the company’s plant, the panel again found that the complaint failed to support its argument that the company’s statements were false. Quality control issues, the panel wrote, are endemic at all pharmaceutical and medical-device producers, and knowing about problems is different from knowing that a facility must be closed and that products must be recalled. “The fact that these particular problems occurred—and that information came out over time, as more news accumulated—does not imply that any manager was lying to investors,” stated the panel. The investors also contended that the company’s top managers had an incentive to make the company look good in order to keep their jobs and improve the value of their bonuses and stock options. This argument actually undermined the inference of scienter, the panel remarked, because there would be very little return for the falsehood, given the relative insignificance of the product to the company’s revenue. In conclusion, the panel affirmed the district court’s judgment, noting that it had addressed the investors’ strongest arguments, and did not see a need to address the others, as it agreed with the district court’s handling of them. Plumbers and Pipefitters Local Union No. 719 Pension Fund v. Zimmer Holdings, Inc. (7thCir) is reported at ¶96,829.

Investors Failed to Show Fraud in Alleged Delay of Impairment Test. A 2nd Circuit panel affirmed a district court judgment dismissing a complaint for failure to state a claim. The action arose out of a media company’s performance of an interim impairment test on its existing goodwill. Investors brought Exchange Act fraud claims against the company alleging that it knowingly or recklessly made false statements about both its goodwill and general financial condition. Specifically, the investors claimed that the company was aware of information that should have led it to perform the impairment test at an earlier date.

On appeal, the investors argued that their allegations that the company delayed interim impairment testing of its intangible assets despite indicia that such a test was necessary earlier stated a claim for securities fraud. The panel cited an earlier opinion stating that, in this context, in order to plead a material misstatement or omission, a plaintiff must plausibly allege that the defendants did not believe their statements about goodwill at the time they were made. Here, the investors cited FASB standards and maintained that the company’s deteriorating financial state mandated that an earlier interim test be performed.

The court was not persuaded by the investors’ argument, and concluded that the complaint contained only conclusory statements supporting the assertion that the company had knowledge that would have led it to perform the test at an earlier date. The allegations, even viewed together, the court continued, did not demonstrate that the company knew, or had reason to know, “at any specific time during this period that it was more likely than not that interim impairment testing would reveal that the goodwill of any specific reporting unit was overvalued.” At most, the court concluded, the investors pleaded a violation of GAAP rather than securities fraud. Finally, the court found that the complaint failed to allege that the stock’s market price was inflated by a fraud in failing to timely undertake the interim impairment testing. All of the alleged red flags calling for impairment testing were already matters of public knowledge and would have been reflected in the market price, the court stated. City Of Omaha, Nebraska Civilian Employees’ Retirement System v. CBS Corporation (2ndCir) is reported at ¶96,825.

Brokers’ Oral Misrepresentations and Omissions Were Material. An 11th Circuit panel concluded that a district court erred in granting summary judgment in favor of the defendant in an SEC enforcement action. The action concerned Morgan Keegan & Company, Inc.’s sales of auction rate securities (“ARS”). The Commission alleged that Morgan Keegan misrepresented that ARS had no liquidity risk and were equivalent to cash and, despite numerous auction failures and other signs of trouble in the ARS market, continued to recommend ARS as short-term, liquid investments while failing to disclose the known liquidity risk. The Commission cited the testimony of four customers who claimed to have been misled by Morgan Keegan brokers and who had never seen Morgan Keegan’s public disclosures of its ARS practices. The district court described this case as one in which the Commission claimed that “Morgan Keegan misled the public through the oral statements made to four individuals” and granted summary judgment in favor of Morgan Keegan after concluding that the Commission “must do more than show a few isolated instances of alleged broker misconduct.”

The appellate court only addressed the issue of materiality, since the district court assumed the Commission met the other elements of its claim and the parties on appeal only addressed that element. Morgan Keegan argued that only a small subset of customers was misled, and materiality in an SEC enforcement action should be evaluated in the context of disclosures to the public as a whole. The panel disagreed, noting that the Supreme Court’s materiality standard invokes a hypothetical reasonable investor, not just the public at large. “In other words,” explained the panel, “the materiality test requires the court to consider all the information available to the hypothetical reasonable investor, which necessarily includes private communications.” Morgan Keegan’s oral misstatements were not immaterial merely because they were not made publicly, the panel wrote.

Continuing, the court observed that to exclude all individual broker-investor communications from the materiality inquiry would be underinclusive because a hypothetical reasonable investor is likely to consider the broker’s statements when making investment decisions. Moreover, the panel stated, there was no precedent for Morgan Keegan’s argument that there is some threshold number of investors that must be misled before finding the misrepresentations to be material. Four Morgan Keegan brokers acting within the scope of their authority made misrepresentations, and the Commission could accordingly establish a securities violation with respect to each of the four.

The panel then concluded that whether Morgan Keegan’s written disclosures discussing liquidity risks rendered the brokers’ conflicting oral misrepresentations immaterial was an issue for the trier of fact. The panel found that the way in which Morgan Keegan distributed its written disclosures was insufficient to warrant summary judgment in its favor because there was no evidence that these disclosures were provided directly to customers other than at their request. Accordingly, the panel concluded that because Morgan Keegan’s written disclosures were only distributed in a “weak or non-effective manner,” the brokers’ misleading statements and failures to disclose the liquidity risks could have been seen as significantly altering the total mix of available information. The district court’s order was vacated and remanded for proceedings consistent with the panel’s opinion. SEC v. Morgan Keegan & Company, Inc. (11thCir) is reported at ¶96,820.

2nd Circuit: Certification Properly Denied in RMBS Case. The 2nd Circuit, in an unpublished order, did not disturb a lower court’s decision declining to certify a class in a mortgage-backed securities case. The plaintiffs sought relief under Securities Act Section 11, which establishes liability if a registration statement contained material misstatements or omissions. While Section 11 does not require proof of scienter to establish a prima facie case, the statute provides an affirmative defense for defendants if the issuer can prove that at the time of the acquisition that the purchaser knew of the claimed untruth or omission. The district court denied Rule 23(b)(3) class certification, as it found that individual, not common, issues would predominate and that class adjudication would not be superior to individual actions.

The 2nd Circuit noted that while reviewing courts are “noticeably less deferential when the district court has denied class status than when it has certified a class,” there was no abuse of discretion in this case by the trial court. The defendants presented evidence that individual knowledge inquiries might be necessary. In addition, the court noted the “cumbersome” class definitions. The complaint sought recovery for all purchasers from the IPO forward, rather than choosing a narrower class definition focused on this more readily identifiable, homogeneous group, such as purchasers on specified dates. Under the proposed class definitions, the purchasers of each security who purchased at different times would have had available different levels of public information. Because public information could constitute circumstantial evidence of individual purchaser knowledge, the defendants would have stronger or weaker evidence of purchaser knowledge for each defendant based on purchase timing. New Jersey Carpenters Health Fund v. RALI Series 2006-QO1 Trust (2ndCir) is reported at ¶96,817.

CCH Blue Sky Law Reporter

Idaho Interprets “Present in this State” and “Sale” from Limited Offering Exemption for Start-Up Company’s Sole Investors (from Out-of-State). The Senior Securities Analyst for the Idaho Securities Bureau, in a no-action letter grant of the limited offering exemption for sales or offers to sell an issuer’s securities to not more than 10 purchasers present in this state during a 12-month consecutive period, interpreted the term “present in this state” as either residents of Idaho or within Idaho’s borders at the time of the sale, and reiterated from Section 30-14-102 (26) of the Idaho Uniform Securities Act, the definition of a sale as “every contract of sale, contract to sell, or disposition of, a security or interest in a security for value,” with a transaction considered a sale at the time value is given for the security. The start-up company requesting the limited offering exemption at Section 30-14-202 (14) of the Idaho Act was comprised solely of the company’s two owner-investors who resided not in Idaho but in Washington State. ¶21,728.

Missouri Offers Guidance on Crowdfunding Exemption…Following President Obama’s signing the Jumpstart Our Business Startups Act (“JOBS Act”) into law on April 5, 2012, Missouri has taken the lead among the states to guide small businesses on the use of the crowdfunding exemption, a crucial part of the JOBS Act. The crowdfunding exemption as applied under the new Act allows small businesses and start-up companies to raise capital by making securities offerings to the public on the Internet without having to register the offerings at the federal or state level. The following caveats, however, are provided by the Missouri Securities Division: (1) Enterpreneurs and issuers may not claim the crowdfunding exemption until the SEC adopts rules regulating use of the exemption. As rules may not be in place until 2013, entrepreneurs and issuers making interim Internet offerings to the public risk liability for fraud, as well as subjecting themselves to state administrative enforcement actions; and (2) Even after SEC crowdfunding rules are adopted: (a) the amount of securities an investor may purchase from an issuer is limited to the amount of the investor’s annual income or net worth, e.g, an investor with less than $100,000 in annual income or net worth may only purchase securities in an amount not exceeding either $2,000 or 5% of the investor’s annual income or net worth, whichever amount is greater; (b) issuers must offer their securities through an SEC-registered broker or funding portal; and (c) while the crowdfunding exemption exempts issuers from federal and state registration requirements, the broker or funding portal must comply with disclosure requirements, by making certain disclosures to the SEC and investors. ¶35,600G.

…Announces Proposed Private Fund Adviser Exemption in Advisory Release…A proposed private fund adviser exemption to replace Missouri’s current de minimis exemption in light of the Dodd-Frank Act’s elimination of the federal exemption at Section 203(b)(3) was announced by the Securities Division in an advisory release. ¶35,600H.

…And Proposes Private Fund Adviser Exemption. As proposed, private fund advisers would be exempt from investment adviser registration requirements if neither the advisers nor their advisory affiliates are subject to “bad boy” disqualification provisions under Rule 262 of federal Regulation A, and the advisers electronically file through the IARD the SEC-filed reports and amendments required for exempt reporting advisers by Rule 204-4 of the Investment Advisers Act of 1940. The exemption would take effect when the reports and amendments are filed and accepted by the IARD on the State’s behalf, assuming the exemption’s other conditions are met. ¶35,448.

Texas Adopts Performance Fee and Administrative Procedure Rule Amendments…A performance-based fees rule for investment advisers was amended by the Texas Securities Board, by replacing some of the language from SEC Rule 205-3 that defines a “qualified client” with a statement that incorporates the entire SEC Rule. Other changes were made to the rules of practice in contested cases to more closely align the rules with the Texas Securities Act, the Administrative Procedures Act and the rules of the State Office of Administrative Hearings. Provisions cover administrative hearing notices and costs; burden of proof; subpoenas and depositions; default; informal dispositions, decisions and orders by the Securities Commissioner; motions for rehearing; records; and ex parte communications. Other changes correct a cross-reference in a shelf registration rule and update a citation to the Texas Development Corporation Act. ¶55,521 through ¶55,535E, ¶55,590A, ¶55,595L and ¶55,691.

…And Proposes Expedited Review of Registration for Qualified Military Spouses. Qualified military spouses whose applications are delayed more than five days after submission could file Texas Form 133.4, Military Spouse Request for Expedited Review, requesting immediate review by a staff member of the Texas Securities Board’s registration division followed by written notification of the reasons for the applications’ pending or deficient status. ¶55,591Q, ¶55,595Q, ¶55,688D.

Texas: Purchaser of Secured Notes Did Not Incur Aider Liability. In Highland Capital Management, L.P. v. Ryder Scott Co., the Texas Court of Appeals held that a purchaser of secured notes was not secondarily liable for aiding the issuer’s alleged violations of the Texas Securities Act (Act) because the purchaser lacked general awareness of any overall scheme to defraud the unsecured creditors. The appellate court relied on Texas Supreme Court precedent which holds that Section 33F of the Act contains a “general awareness requirement, whereby a plaintiff must prove that an aider was aware of the primary violator’s improper activities before the alleged aider may be held liable for assisting in the securities violation. The appellate panel reasoned that the purchaser was entitled to summary judgment because it conclusively showed, as a matter of law, that it was not aware that the issuer’s proved oil reserve estimates were inflated, an allegation central to the plaintiffs’ claims.

The appellate court noted that the affidavits offered by the purchaser of the secured notes explicitly stated that the purchaser was not aware that the proved reserve estimates supplied by a petroleum engineering firm were inaccurate or contained irregularities. Moreover, the evidence showed that the purchaser was unaware that the proved reserve estimates would later be reduced by the engineering firm, while also demonstrating that the purchaser relied on those reserve estimates in deciding to loan funds to the issuer. Although the plaintiffs asserted that a genuine issue of material fact existed because the purchaser learned that the estimates were inflated when it reviewed the reserve reports as part of its due diligence, the evidence offered by the plaintiffs only raised, at best, a question whether the purchaser’s engineers were negligent in their due diligence review, a standard that does not satisfy the scienter requirement for aider liability under Section 33F. The plaintiffs’ argument that the purchaser gained knowledge that the reserve estimates were inflated by sharing a director with the issuer also failed because the plaintiffs offered no evidence showing that the information was transmitted to the director. Accordingly, the purchaser met its summary judgment burden by negating the element of general awareness as a matter of law. Highland Capital Management, L.P. v. Ryder Scott Co. is reported at ¶74,977.

Aspen Federal Securities Publications

Regulation of Securities: SEC Answer Book, Third Edition, by Steven Mark Levy. The 2012-2 Supplement will soon be available online. This practical guide aids the reader in understanding and complying with the day-to-day requirements of the federal securities laws that affect all public companies. Using a question-and-answer format similar to that which the SEC has embraced, this guide provides clear, concise, and understandable answers to the most frequently asked securities compliance questions. The 2012-2 Supplement features a completely rewritten Chapter 23, “Investment Advisers,” to reflect major regulatory developments, including those brought about by the Dodd-Frank Act. Topics that have been added include the “family office” exclusion; new exemptions for advisers to venture capital funds, private fund advisers, and foreign private advisers; and Forms ADV (used for registration and reporting) and PF (used to report systemic risk information). There are also substantial revisions to the sections on antifraud proscriptions, fiduciary duty, supervision, recordkeeping, and enforcement.

The 2012-2 Supplement also includes a variety of other timely topics, including: Are crowdfunding investments securities? What rules of conduct govern SEC members and employees? What is cybersecurity, and when do existing regulations require disclosure of cybersecurity risk? How do the beneficial ownership reporting rules apply to persons who use security-based swaps? What constitutes retaliatory adverse action for purposes of establishing a whistleblower claim under Sarbanes-Oxley Section 806? What is the relevance of PCAOB inspections to the audit committee, and what questions should the audit committee pose to its auditor regarding the auditor’s PCAOB inspection? What are the requirements for submitting revisions to a shareholder proposal? May the company take the initiative and sue for a declaratory judgment that a shareholder proposal is excludable, even if the shareholder has no intention to file suit challenging the exclusion? Can an attorney qualify for a Dodd-Frank Act whistleblower award? Can compliance personnel and internal auditors qualify for an award? How does the SEC screen incoming whistleblower tips on Form TCR? What are the potential penalties for doing business as a broker-dealer without proper registration? Must broker-dealers that provide market access to customers establish risk management controls designed to limit their financial exposure arising from such access? What is market manipulation, and what are the statutory and regulatory proscriptions against manipulating the securities market? How and why does the SEC collect information on the trading activity of large traders? What is the scope of SEC and FINRA disciplinary authority over broker-dealers?

IPO Vital Signs

IPO Vital Signs, an advanced IPO research analysis tool, assists IPO professionals and pre-IPO companies satisfy their most challenging research needs and answers hundreds of mission critical questions for all the players in the IPO process. IPO Vital Signs’ tabular data analyses focus on issues surrounding client advisement, deal negotiation, and prospectus disclosure.

IPO Week in Review, a weekly e-newsletter to keep professionals up to date with recent filing and going public activity, is an important element of the IPO Vital Signs system or is available by separate subscription. Coverage includes a monthly feature article on recent trends in going public in the U.S.

To see how an IPO Vital Sign works click on the Vital Sign title below:

Free Preview!>> |

#320 – Industry Sectors

|

Tip! Click on blue numbers to drill down for more information. Once in the drill down, click column headings to sort the data in an order more useful for answering your questions.

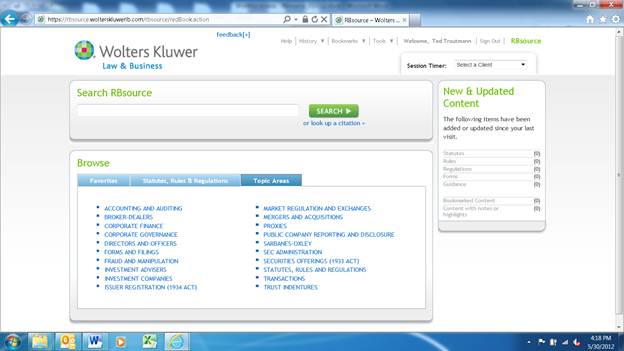

RBsource

A new research tool powered by the Securities Redbook (Securities Act Handbook), RBsource offers you securities laws, rules, regulation and forms together with related SEC guidance and interpretations. With RBsource, you will have SEC guidance related to a specific law, regulation or rule at your fingertips without the need of further searching or browsing. RBsource uniquely associates related content, going beyond the limits of standard searching making research more streamlined and productive. This intuitive research tool will drastically reduce your research time and provide the unparalleled confidence expected from the trusted Securities Act Handbook.

SEC Rulemaking Activity

- 34-66868—Further Definition of “Swap Dealer,” “Security-Based Swap Dealer,” “Major Swap Participant,” “Major Security-Based Swap Participant” and “Eligible Contract Participant.”

These rules jointly adopted by the SEC and the Commodity Futures Trading Commission (CFTC), in consultation with the Fed, represent a major step toward full implementation of the OTC derivatives provisions set forth in Dodd-Frank Act Title VII. The SEC rules were unanimously adopted at an open meeting April 18, 2012. The joint rule release was issued April 27, 2012. Most provisions are effective July 23, 2012, except for some CFTC rules and an interim final rule.

- IA-3403—Technical Amendment to Rule 206(4)-5: Political Contributions by Certain Investment Advisers.

The rule amends Investment Advisers Act Rule 206(4)-5 to correct a prior error in the definition of “covered associate.” The amendment is effective May 15, 2012.

Search Tip

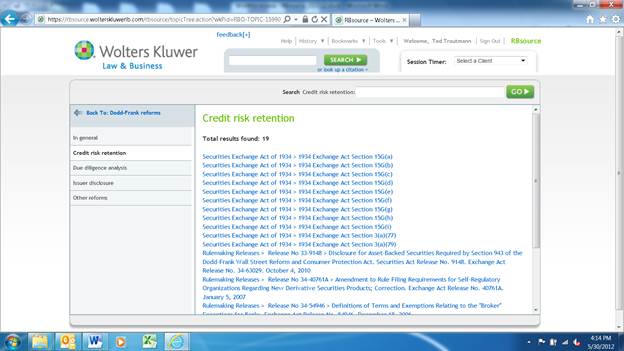

RBsource enables searching by topic area. Once signed-in, click on the “Topic Areas” tab in the Browse pane.

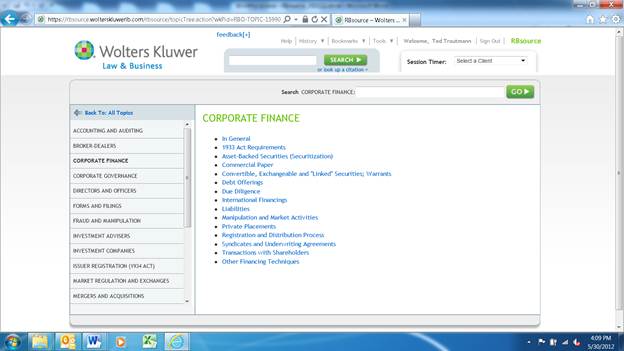

Then, select a topic relevant to your research assignment. Topics cover a range of securities laws and regulations, including accounting and auditing, broker-dealers, corporate governance, fraud, market regulation and exchanges, investment companies and advisers, issuer registration and securities offerings, mergers, public company reporting and disclosure, and the Sarbanes-Oxley Act. For example, try “Corporate Finance.”

If your assignment involved securitizations, you could click on “Asset-Backed Securities (Securitization)” to reveal a list of subtopics that allows you to refine the search.

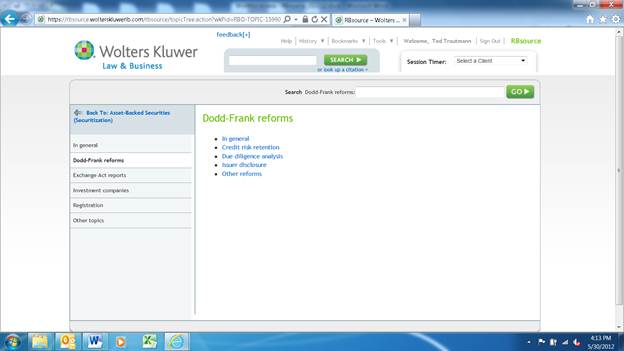

The resulting list permits you to choose from a variety of securitization sub-topics. A key premise underlying the Dodd-Frank Act securitization reforms is that securitizers must have “skin in the game.” Thus, you may want to select “Dodd-Frank reforms” and then choose “Credit risk retention” from the resulting options.

By clicking on “Credit risk retention,” you now can directly access the relevant laws, regulations, and other guidance covering Dodd-Frank Act reforms of asset-backed securities (securitizations) that impose requirements for credit risk retention.

This month’s hot topic is the “In Connection With” requirement. The requirement that a plaintiff must have either purchased or sold a security in order to maintain an action under Section 10(b) has been established law since the U.S. Supreme Court 1975 decision in Blue Chip Stamps v. Manor Drug Stores. A plaintiff is often described as lacking “standing” to maintain an action due to failure to satisfy the purchaser-seller requirement.

Exchange Act Section 10(b) and Rule 10b-5 proscribe fraudulent conduct “in connection with the purchase or sale of any security.” This requires a showing that the fraudulent conduct “touches” the purchase or sale of the securities. Application of the purchaser-seller requirement involves establishment of not only a purchase or sale, but also a nexus between the alleged fraud and the transaction. Because the fraud must be integral to the purchase and sale of the security, a fraud committed after a purchase of securities is completed could not meet the “in connection with” test.

The 10th Circuit recently affirmed a multi-million judgment for the SEC against the operator of an alleged Ponzi scheme. As alleged, the defendant and his firm defrauded multiple investors by representing that their money would be placed in low-risk financial instruments. Rather than making these investments, the defendant allegedly used the funds to cover personal expenses, pay prior investors and engage in high-risk real estate lending. In the process, the defendant allegedly commingled investor funds, fabricated account statements, refused investors’ inquiries about their money, misled investors about his affiliation with a financial-planning firm, gave promissory notes as collateral for investment funds and gave investors bogus financial product-information sheets.

The court rejected defense claims that there were no statements made in connection with a purchase or sale of securities. The “in connection with” requirement should be broadly interpreted to cover any fraud that coincides with a securities transaction, stated the court. The fact that the defendant did not actually sell or buy any securities was not dispositive. The fact that the defendant took investor funds under the pretense that it would be invested in safe securities such as mutual funds was sufficient. In addition, the court noted that the defendant gave investors promissory notes to finance investments. Under these circumstances, the notes constituted securities and the transactions were subject to the antifraud provisions of the securities laws.

We publish related information in a wide range of resources (e.g., Federal Securities Law Reporter, SEC Today, etc.), and document types (laws, regulations, releases, newsletter articles, treatise discussion, Insights – Amy L. Goodman, etc.). For example:

- Federal Securities Law Reporter

- Exchange Act Section 10(b) at ¶22,721

- Exchange Act Rule 10b-5 at ¶22,725

- Blue Chip Stamps v. Manor Drug Stores ((U.S. Sup. Ct.) is reported at 1974-75 CCH Dec. ¶95,200

- SEC v. Smart (10thCir) is reported at ¶96,816

- CCH Explanations (e.g. “‘In Connection With’ Requirement” at¶22,772.080)

- Report letters (e.g., 10-19-11, “Agreement Not In Connection With Sale or Purchase of Securities”)

- Securities Regulation – Loss, Seligman & Paredes (e.g. Chapter 9.B.7.b)

- SEC Answer Book – Levy (e.g., Question 17:15)

- Broker-Dealer Law and Regulation – Poser & Fanto (e.g. §17.01[D][3])

- SEC Topic Navigator

- Jim Hamilton’s World of Securities Regulation