|

|

|

|

March 2012 |

|

From the editors of CCH Federal Securities Law Reporter, CCH Blue Sky Law Reporter and the securities publications of Aspen Publishers, this update describes important developments covered in these publications, as well as timely topics of interest generally to federal and state securities practitioners. This update includes a preview of IPO Vital Signs, an advanced IPO research analysis tool, for IPO professionals and pre-IPO companies. New this month is a preview of RBsource, an all-in-one online securities law resource, powered by the Securities Redbook. Finally, please see the “Hot Topic of the Month,” for research tips and references to CCH and Aspen source material on point.

To view past issues of the Securities Update, please visit http://business.cch.com/updates/securities.

If you have questions or comments concerning the information provided below, please contact me at rodney.tonkovic@wolterskluwer.com.

Financial Reform Resources

CCH Federal Securities Law Reporter

SEC Amends Rule on Advisory Performance Fee Charges. The SEC has adopted amendments to Investment Advisers Act Rule 205-3. The rule allows investment advisers to charge performance based compensation to “qualified clients,” and the amendments revise the dollar amount thresholds of the rule’s tests that are used to determine whether an individual or company is a qualified client. The amendment provides that the assets-under-management threshold is $1 million and that the net worth threshold is $2 million. The amendments also exclude the value of a person’s primary residence and certain associated debt from the test of whether a person has sufficient net worth to be considered a qualified client.Release No. IA-3372 is reported at ¶89,715.

D.C. Circuit Panel Upholds SEC Bar Order. In an unpublished opinion, a District of Columbia Circuit panel upheld the bar from association imposed by the SEC against an investment adviser. In 1997, the Commission filed a civil complaint accusing the adviser of losing $71 million of his clients’ principal investment through conduct involving the misrepresentation of the value of assets held as collateral by municipal bonds in which he had invested client funds. The Commission alleged further that the adviser had misappropriated client funds to pay for business and personal expenses.

The adviser consented to sanctions including a follow-on SEC order barring him from association with any broker, dealer, municipal securities dealer, investment adviser or investment company. In a later order, the Commission vacated a portion of the bar order, but denied the adviser’s petition with respect to the bar on association with any investment adviser or investment company. The adviser challenged that denial on appeal.

The panel upheld the bar order and denied the petition for review. The Commission treated the adviser’s argument that the valuation method of the securities at issue had changed and that the new value analysis would have supported the adviser’s valuations as a collateral attack on the consent and allegations in the complaint. Such collateral attacks are impermissible in follow-on administrative proceedings. The Commission also addressed the merits of the adviser’s claim and found that it was unsupported by evidence.

The panel stated that the Commission applied its multi-factor test in determining that declining to lift the bar was in the public interest. The panel concluded that in the absence of evidence supporting the adviser’s valuation argument, and in light of the overwhelming weight of the other factors, the Commission’s refusal to vacate the bar was not arbitrary, capricious, or an abuse of discretion. The panel accordingly ordered that the adviser’s petition for review be denied. Black v. SEC (DCCir) is reported at ¶96,732.

PIPE Transaction Not Exempt, Funds Were Beneficial Owners. A beneficial owner’s acquisition of securities directly from an issuer, at the issuer’s request and with the board’s approval, is covered by Exchange Act Section 16(b), concluded a 2nd Circuit panel. This action was brought derivatively on behalf of a communications systems company against two funds that owned over 10 percent of the company’s shares. In December 2005 and January 2006, the funds sold company shares in their portfolios on the open market, and, in April 2006, the funds bought company shares in a private investment in public equity, or “PIPE” transaction at a discount from the market price. The shareholder bringing the suit claimed that the funds were liable to the company for short-swing profits and sought their disgorgement. The funds argued that the transaction was issuer-solicited and approved by the board, and thus differed from the type of abusive transactions that Section 16(b) was enacted to prevent. The district court held that because the PIPE transaction was neither hostile nor involuntary, the potential for abuse existed, and the funds were liable for their short-swing profits.

On appeal, the funds argued that the district court erred in determining that the PIPE transaction was not exempt and that the funds were “beneficial owners” under Section 16(b). According to the funds, the transaction was the result of direct negotiations between the funds and the company’s board and should have been exempt from Section 16(b)’s coverage. There was no possibility of speculative abuse, the funds contended, because both the company and the funds had access to the same information. The court concluded that the PIPE transaction was not exempt from Section 16(b)’s coverage. According to the panel, the transaction was not “borderline” or “unorthodox” because the fund had access to inside information and gave the company a volitional capital infusion. The panel noted that the SEC has held that 10 percent holders are presumed to have access to inside information and can influence or control the issuer. Further, an exemption for officers or directors did not apply to the funds, and 10 percent holders are excluded from that exemption because they do not necessarily owe fiduciary duties to the company.

The appellate court then determined that the funds were beneficial owners and liable for short-swing profits. The funds argued that only the two partners who had voting and investment power over the funds’ securities were the only insiders and should have been held liable, but the panel responded that this argument did not square with the basic principles of agency law. The partners were agents with delegated rights and powers over the securities held by the funds, and their actions bound the partnerships. The definition of “person” in Section 16(b) includes “partnerships,” the panel continued. Accordingly, the panel held that the funds were beneficial owners, that April 2006 acquisition was a “purchase” under Section 16(b), and that they were consequently liable for the short-swing profits from that purchase. Huppe v. WPCS International Incorporated (2ndCir) is reported at ¶96,714.

5th Circuit Allows Choice Between Lodestar and Percentage Methods. Upon concluding that objections to a settlement lacked merit, a 5th Circuit panel found no abuse of discretion and affirmed a district court’s judgment. A district court had certified a class and approved a settlement in an action brought by investors in Dell, Inc. According to the complaint, Dell had fraudulently inflated reported revenues, engaged in accounting fraud and disseminated false information to the public. The settlement agreement provided for a payment by Dell of $40 million into a net settlement fund to be allocated among the class members, with 18 percent ($7.2 million) awarded to their attorneys. Two groups of investors objected to the class certification and settlement on a number of grounds.

In response to the objections, the panel found no abuse of discretion in the class certification or in the approval of the settlement. The panel first found that the settlement was fair, adequate, and reasonable. The objectors criticized the district court’s approval based on the lack of formal discovery in the case, but the panel concluded that the court’s rationale that sufficient informal discovery had taken place to inform the parties was thorough and persuasive. Next, there was no abuse in the class being defined as those who were damaged by holding the stock because this was an objective and mechanical standard. Third, the panel found that small investors would not be unduly burdened by the claims-making process. Fourth, regarding objections to the removal of a de minimis provision from the plan of allocation, the panel stated that this did not affect the stipulation of settlement and was, as such, not a reason to reject the settlement. There was also no additional notice or time to file needed after the elimination of the de minimis provision. Finally, the panel found that a second fairness hearing was not necessary because the parties were afforded the full opportunity to present their objections at the first hearing.

Turning to the fee award, the panel again found no abuse of discretion. The panel rejected the objections to the district court’s use of the percentage method to calculate the fee award. Prior to this action, the 5th Circuit had not explicitly endorsed the percentage method, but was amenable to its use as long as courts used the factors previously enumerated by the 5th Circuit as a reasonableness check. The panel explicitly endorsed the use of the percentage method, cross-checked with the circuit’s reasonableness factors, and joined the majority of the circuits in allowing district courts to choose between the percentage and lodestar methods in common fund cases. The panel then found no basis to consider the award excessive and no abuse of discretion in awarding interest. Union Asset Management Holding A.G. v. Dell, Inc. (5thCir) is reported at ¶96,726.

CCH Blue Sky Law Reporter

California Extends Date for Commenting on Private Fund Adviser Exemption. The public comment period for the following private fund adviser exemption was extended from February 20, 2012 to March 25, 2012. While no public hearing is currently scheduled, Comments may be mailed to the Department of Corporations, Attn: Karen Fong, Office of Legislation and Policy, 1515 K Street, Suite 200, Sacramento, CA 95814, or emailed to regulations@corp.ca.gov, or faxed to (916)-322-5875. An exemption from investment adviser registration was proposed for private fund advisers by the California Department of Corporations. The exemption, if adopted, would replace the currently effective de minimis exemption that has been extended by emergency for 90 days from January 18, 2012 and anticipated to become inoperative on June 28, 2012. The proposed exemption would require private fund advisers to meet certain conditions, including the advisers not being subject to specified “bad boy” disqualification provisions, submitting SEC-filed reports required by Rule 204-4 of the Investment Advisers Act of 1940, and paying the $125 adviser registration fee to make the exemption effective for one year. Additional requirements would apply to private fund advisers to 3(c)(1) funds. ¶12,167D.

Indiana Issues Private Equity/Venture Capital Fund Administrative Order In Connection with IA Registration. An administrative order by the Indiana Securities Division extends a 2008 policy statement on private equity/venture capital funds and investment adviser registration by providing a post-Dodd-Frank Act IA registration exemption for the funds following that Act’s elimination of the Section 203(b)(3) de minimis exemption for investment advisers. Effective January 9, 2012 and until the Division can adopt a rule for these funds, no enforcement action will be taken against any person that fails to register in the State as either an investment adviser or investment adviser representative, provided: (1) the person maintains a place of business in Indiana; (2) has had not more than five client residents of Indiana during the preceding 12 months; (3) does not hold itself out generally to the public as an investment adviser; and (4) advises a qualified fund as defined under SEC Rule 203(m)-1, if neither the fund’s adviser nor any of the adviser’s affiliates are subject to federal Regulation A “bad boy” disqualification provisions. Other exemption conditions are specified in the administrative order. ¶24,722.

Massachusetts Provides Guidance on Use of Social Media by Investment Advisers. Investment advisers that discuss business with existing or prospective clients on any of the 21st Century Internet platforms for socializing, e.g., Facebook, Twitter or LinkedIn, must be aware that their communications may be subject to state regulation, according to the Massachusetts Securities Division. Investment advisers do not violate Massachusetts’ investment adviser rules per se by using the new social media but must be particularly mindful of the State’s advertising, recordkeeping and supervisory requirements because of the risk for harming a large number of investors by virtue of the media’s ability to reach an immensely wide audience. ¶31,664.

Missouri Participates in NASAA’s Coordinated Review Program for Switching Advisers. Mid-size investment advisers, i.e., advisers with assets under management of between $25 million and $100 million, that are switching from federal to state registration in 4 to 14 states including Missouri may participate in the coordinated review program of the North American Securities Administrators Association (NASAA) until the program ends on March 30, 2012 (advisers registered in 15 or more states may remain federally-registered). Eligible investment advisers may enroll by submitting to NASAA the Coordinated Review Form found on NASAA’s website http://www.nasaa.org/ after electronically filing through the IARD all materials required to apply for registration in each of the 4 to 14 states where the advisers are applying. Note that there is no additional cost to participate in the program but advisers remain subject to the filing fees required to apply for registration in each state. ¶35,600E.

Texas Adopts IA Custody Rule and Written Exam Rules. A safekeeping rule for investment advisers with custody of their clients’ funds or securities was adopted by the Texas Securities Board, together with amendments to the written examination rules for dealer principals, agents, investment advisers and investment adviser representatives. The “solicitor” definition was clarified. NOTE: A rule on performance based advisory fees remains proposed. ¶55,595P and ¶55,690.

Texas Proposes Administrative Procedure Rule Amendments. Amendments to the rules of practice in contested cases were proposed by the Texas Securities Board to more closely align the rules with the Texas Securities Act, the Administrative Procedures Act and the rules of the State Office of Administrative Hearings. Provisions would cover administrative hearing notices and costs; burden of proof; subpoenas and depositions; default; informal dispositions, decisions and orders by the Securities Commissioner; motions for rehearing; records; and ex parte communications. Other proposed changes would correct a cross-reference in a shelf registration rule and update a citation to the Texas Development Corporation Act. ¶55,521 through ¶55,691.

Martin Act Does Not Preempt Common Law Claims, New York High Court Rules. The New York Court of Appeals has held that the New York Blue Sky Law (Martin Act) does not preempt common law claims involving securities. In Assured Guaranty (UK) Ltd. v. J. P. Morgan Investment Management Inc., the state high court ruled that the statute did not preempt the plaintiff’s causes of action for breach of fiduciary duty and gross negligence arising from the defendant’s management of an investment portfolio. The decision appears to have settled a longstanding question concerning the viability of common law securities claims by private litigants under New York law.

Although the defendant contended that the Martin Act vests the Attorney General with exclusive authority over fraudulent securities and investment practices, the court reasoned that the plain text of the statute, while granting the Attorney General investigatory and enforcement powers and prescribing various penalties, does not expressly mention or otherwise contemplate the elimination of common law claims. Moreover, nothing in either the original conception of the Martin Act in 1921 or any of the subsequent amendments demonstrates a “clear and specific” legislative mandate to abolish preexisting common law claims that private parties would otherwise possess in the securities field. Assured Guaranty (UK) Ltd. v. J. P. Morgan Investment Management Inc. is reported at ¶74,960.

Aspen Federal Securities Publications

Broker-Dealer Law and Regulation, Fourth Edition, by Norman S. Poser and James A. Fanto. The 2012 Supplement is now available online. This is an authoritative, analytical and practical guide for advising clients on their rights, duties, and liabilities under today’s complex securities regulations. It provides reliable guidance on the latest federal and state law governing private litigation and arbitration between broker-dealers and their customers, as well as regulation by the SEC and the SROs. The 2012 Supplement includes: discussion of recent jurisprudence on the need of persons to register as a broker-dealer and of SEC rulemaking with respect to security-based swap dealers and the market structure for security-based swaps; review of the registration requirements for FINRA’s new registration category of operations professional; analysis of broker-dealer obligations under the SEC’s new large trader reporting rules; examination of the SEC’s proposed Rule 17Ad-17 relating to lost securityholders; discussion of FINRA’s continuing guidance on the use of social media by associated persons; discussion of a broker-dealer’s reporting requirements under FINRA Rule 4530 dealing with reporting of firms and persons posing regulatory risks; a discussion of examination priorities of the SEC, FINRA, and state securities regulators; discussion of significant FINRA and SEC enforcement actions under Regulation S-P and of FINRA proposed Rule 3230 on telemarketing to replace existing NASD and NYSE rules; extensive review of noteworthy FINRA and SEC supervision cases; a detailed discussion of the proposed joint regulations by federal financial regulators on incentive-based compensation in financial firms and of FINRA’s proposed Rule 2121 relating to fair prices, markups, markdowns, and commissions; examination of a broker-dealer’s obligations under FINRA’s new financial responsibility rules and under FINRA’s new rule on fidelity bonds; review of FINRA’s updated rules on improper IPO practices; review of prominent FINRA and SEC enforcement proceedings and an in-depth discussion of a broker-dealer’s obligations under the SEC’s new whistleblower rules; an SEC report recommending rules that would establish a standard of conduct for broker-dealers and investment advisors who give investment advice to retail customers; review of the U.S. Supreme court decisions in Janus Capital Group, Inc. v. First Derivative Traders and Matrixx Initiatives, Inc. v. Siracusano; review of FINRA’s new suitability and know-your-customer rules, which are scheduled to take effect on July 9, 2012; discussion of FINRA’s new arbitration rule allowing a customer in a dispute with a broker-dealer or associated person to opt for a panel composed exclusively of public (i.e., non-industry) arbitrators; and analysis of New York’s abandoning of the “manifest disregard of the law” standard for judicial review of an arbitration award in favor of a three-prong standard: violating public policy, irrationality, and exceeding the arbitrators’ power.

Practicing Under The U.S. Anti-Corruption Laws, by Joseph P. Covington and Iris E. Bennett. The 2012 Supplement will soon be available on IntelliConnect. Practicing Under The U.S. Anti-Corruption Laws is designed to assist practitioners and company counsel to comply with the Foreign Corrupt Practices Act (FCPA) and all major U.S. anti-corruption laws. It discusses a wide range of issues relevant to counseling and defending companies and individuals with respect to U.S. anti-corruption laws and how they impact the conducting of business in the international marketplace. The 2012 Supplement expands the scope of the publication to provide essential new information including: important changes in the FCPA-related provisions of the federal securities law due to the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the Department of Justice’s (DOJ) recent use of money laundering laws to prosecute the Thai officials alleged to have been the recipients of bribes in the Gerald and Patricia Green case; the DOJ’s efforts to demonstrate meaningful credit for voluntary disclosure in the Panalpina matter; the future of FCPA investigative efforts in light of the mistrial in the first Catch-22 case to go to trial; the federal courts’ reluctance in a number of closely watched cases to sentence individual defendants to the severe sentences sought by the DOJ; updated list of all FCPA enforcement actions brought by the SEC through September 2011; explanation of recent trends and data on SEC FCPA enforcement actions; implementation and potential consequences of the new Dodd-Frank Whistleblower Program; recent trends in compliance program-related provisions of DOJ and SEC settlement agreements; unique risks posed by third-party agents in foreign countries that should be assessed as part of any FCPA internal investigation; recent case law regarding when privilege can be asserted over the contents of an internal investigation; areas of sensitivity that should be addressed if an FCPA internal investigation is instigated by a whistleblower complaint; developments in emerging market countries, including significant new anti-corruption legislation and the latest foreign and domestic bribery cases; analysis of new developments in enforcement trends in Germany, China, India, Mexico, Nigeria, and the Russian Federation; and updates on national anti-corruption laws and specific cases brought in multiple jurisdictions.

IPO Vital Signs

IPO Vital Signs, an advanced IPO research analysis tool, assists IPO professionals and pre-IPO companies satisfy their most challenging research needs and answers hundreds of mission critical questions for all the players in the IPO process. IPO Vital Signs’ tabular data analyses focus on issues surrounding client advisement, deal negotiation, and prospectus disclosure.

IPO Week in Review, a weekly e-newsletter to keep professionals up to date with recent filing and going public activity, is an important element of the IPO Vital Signs system or is available by separate subscription. Coverage includes a monthly feature article on recent trends in going public in the U.S.

To see how an IPO Vital Sign works click on the Vital Sign title below:

![]()

Free Preview!>> |

What are the financial profiles of IPO issuers?

IPO professional activity in terms of number of IPOs filed |

Tip! Click column headings to sort the data in an order more useful for answering your questions. Use Ranked by in the upper left hand corner of the table to select multiple columns by which to rank the data. For instance, you can select SIC Code in ascending order and then Revenue in descending order to sort IPOs in order of SIC and revenue size.

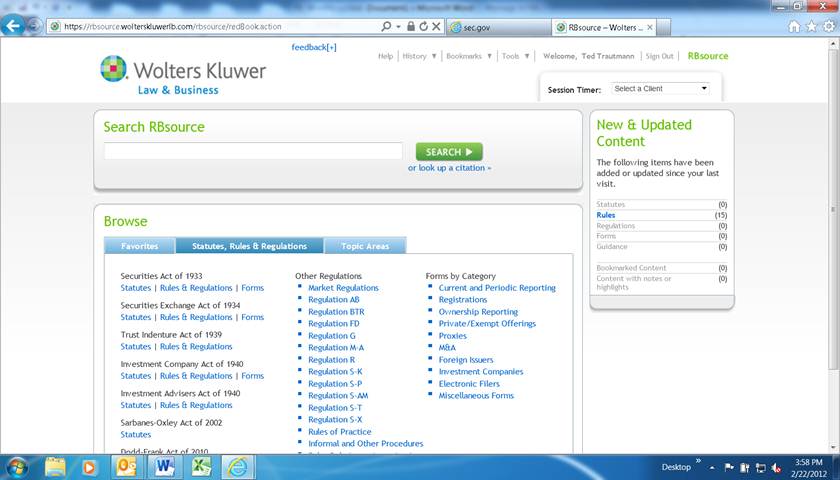

RBsource

A new research tool powered by the Securities Redbook (Securities Act Handbook), RBsource offers you securities laws, rules, regulation and forms together with related SEC guidance and interpretations. With RBsource, you will have SEC guidance related to a specific law, regulation or rule at your fingertips without the need of further searching or browsing. RBsource uniquely associates related content, going beyond the limits of standard searching making research more streamlined and productive. This intuitive research tool will drastically reduce your research time and provide the unparalleled confidence expected from the trusted Securities Act Handbook.

Recently added SEC rulemaking releases

- IA-3372 Investment Adviser Performance Compensation

The SEC amended Investment Advisers Act Rule 205-3. The rule permits investment advisers to charge performance based compensation to “qualified clients.” The amended rule modifies the dollar thresholds used to determine who is a qualified client. The amended rule also requires the SEC to issue an order every five years to adjust the dollar thresholds for inflation, excludes the value of one’s primary residence and other items from the test for net worth to be a qualified client, and establishes transition rules.

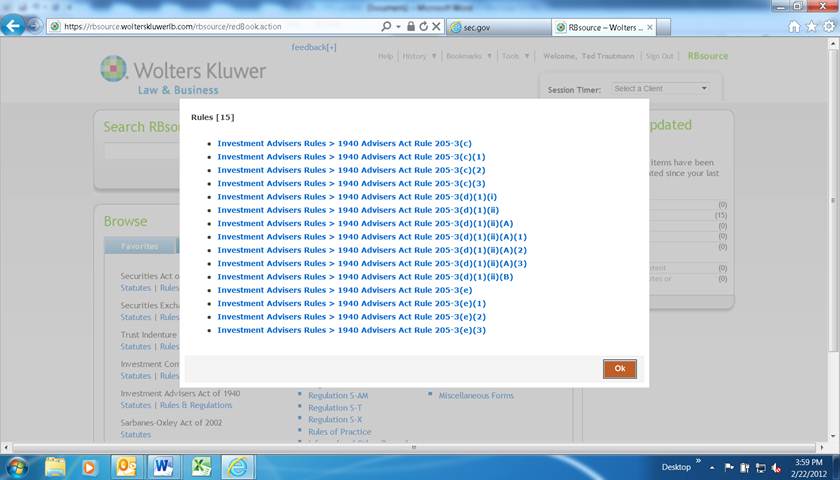

Search Tip: New & Updated Content

From the post-logon home page, select a type of updated content from the right pane titled New & Updated Content. For example, click on the “Rules” link to display recently amended sections of Investment Advisers Act Rule 205-3. Click the link to a specific section of the amended rule to view the current and amended text plus links to related content and guidance.

Search Tip: Finding Rulemaking Releases

To find the text of a rulemaking release:

1. Under the search button, select “or look up a citation.”

2. From the drop-down menu, choose “SEC Guidance.”

3. Refine the search by selecting “Rulemaking Release No.” from the second drop-down menu.

4. Enter the release number (e.g. 33-9295).

5. Click “Search.”

RBsource returns three sets of search results. The center navigation pane displays the full text of the rulemaking release. The text can be searched electronically or manually scroll to the desired section. The left navigation pane contains links to key sections of the release text. Finally, the right navigation pane displays links to related content and guidance plus any relevant editor’s notes.

To learn more about the product or sign up for a 14-day trial please go to: http://RBsource.wolterskluwerlb.com or contact your WKL&B account representative for more information.

This month’s hot topic is recent developments concerning the whistleblower provisions of the securities laws. The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) repealed former Exchange Act Section 21A(e), which authorized monetary rewards for information leading to the recovery of civil penalties for insider trading violations, and created a broader program for making monetary awards to whistleblowers under new Exchange Act Section 21F. Under new Section 21F, the Commission may use funds collected as sanctions in judicial or administrative proceedings to pay rewards for original information about a violation that leads to a successful enforcement action. The Commission adopted final rules implementing the program that were effective in August 2011.

The final rules define a “whistleblower” as a person who provides information to the SEC relating to a possible violation of the securities laws that has occurred, is ongoing or is about to occur. Original information must be based upon the whistleblower’s independent knowledge or independent analysis, not already known to the Commission and not derived exclusively from certain public sources. The regulations lengthen the period of time in which a whistleblower can wait before coming to the SEC, after reporting internally. Whistleblowers will now be able to get credit for the original date they reported to their company so long as they notify the SEC within 120 days. Through this provision, employees would be able to report their information internally first while preserving their place in line for a possible award from the SEC. Moreover, the regulations clarify that the Commission, when considering the amount of an award, will consider how much a whistleblower has participated in the internal compliance process. The final rules would also give credit to a whistleblower whose company passes the information along to the Commission even if the whistleblower does not.

Under the new rules, whistleblowers also receive greater protections from retaliation. A whistleblower who provides information to the Commission is protected from employment retaliation if the whistleblower possesses a reasonable belief that the information he or she is providing relates to a possible securities law violation that has occurred, is ongoing, or is about to occur. In addition, the rules make it unlawful for anyone to interfere with a whistleblower’s efforts to communicate with the SEC, including threatening to enforce a confidentiality agreement.

In fiscal year 2011 following the effective date of the new rules, the Commission’s newly-created Office of the Whistleblower in the Division of Enforcement received 334 tips from whistleblowers. The most common complaint categories were market manipulation, corporate disclosures and financial statements, and offering fraud. Due to the timing of the adoption of the rules late in fiscal year 2011, no awards were paid during that period.

In a case of first impression in the circuit courts, a 1st Circuit panel recently held that employees working for contractors or subcontractors of public companies are not protected by the Sarbanes-Oxley whistleblower provision, Section 806. The panel concluded that only the employees of the defined public companies are covered by the whistleblower provisions, and if Congress intended a broader meaning, it could amend the statute. First, the principles of statutory interpretation led the panel to interpret the provision as unambiguously in favor of limiting its protection only to employees of public companies. Next, Congress explicitly enacted broader protection for whistleblowers in other SOX provisions, but chose different and more limited language for Section 806. The legislative history of this and other sections of SOX also confirmed the panel’s interpretation.

We publish related information in a wide range of resources (e.g., Federal Securities Law Reporter, SEC Today, etc.), and document types (laws, regulations, releases, newsletter articles, treatise discussion, Insights – Amy L. Goodman, etc.). For example:

- Federal Securities Law Reporter

- Exchange Act Section 21F at ¶26,423ZA

- Exchange Act Rules 21F-1 at ¶26,423ZB through 21F-13 at ¶26,423ZN

- Dodd-Frank Act Section 922 at ¶58,168

- Sarbanes-Oxley Act Section 806 at ¶62,907

- Exchange Act Release No. 34-64545 is reported at ¶89,450

- Exchange Act Release No. 34-64778 is reported at ¶89,479

- Lawson v. FMR, LLC (1stCir) is reported at ¶96,721

- Report letters (e.g., 2-29-12, “SEC Staffers Discuss Enforcement Issues”)

- Dodd-Frank Wall Street Reform and Consumer Protection Act: Law, Explanation and Analysis (e.g. ¶4060)

- Federal Securities QuickCharts – Dodd-Frank Act (e.g., Whistleblowers topic)

- Insights – Amy L. Goodman “SEC Adopts Final Rules Implementing Whistleblower Provisions of Dodd-Frank” (June 2011)

- Jim Hamilton’s World of Securities Regulation (e.g. 2-7-12, (discussing Lawson))