|

|

|

|

May 2012 |

|

From the editors of CCH Federal Securities Law Reporter, CCH Blue Sky Law Reporter and the securities publications of Aspen Publishers, this update describes important developments covered in these publications, as well as timely topics of interest generally to federal and state securities practitioners. This update includes a preview of IPO Vital Signs, an advanced IPO research analysis tool, for IPO professionals and pre-IPO companies. New this month is a preview of RBsource, an all-in-one online securities law resource, powered by the Securities Redbook. Finally, please see the “Hot Topic of the Month,” for research tips and references to CCH and Aspen source material on point.

To view past issues of the Securities Update, please visit http://business.cch.com/updates/securities.

If you have questions or comments concerning the information provided below, please contact me at rodney.tonkovic@wolterskluwer.com.

Financial Reform Resources

CCH Federal Securities Law Reporter

SEC Adopts Rule Defining Swaps-Related Terms for Regulating Derivatives. The SEC unanimously adopted a new rule to define a series of terms related to the over-the-counter swaps market. The rules, written and adopted jointly with the CFTC, implement provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act that established a comprehensive framework for regulating derivatives. The new rules define the terms “swap dealer,” “security-based swap dealer,” “major swap participant,” “major security-based swap participant,” and “eligible contract participant.” The term “swap dealer” will encompass firms conducting swaps of derivatives with a value of $8 billion a year. The original proposal suggested a $100 million de minimis threshold. Under the Dodd-Frank Act, the SEC has oversight over “security-based swaps,” of which most are single-name credit default swaps. The threshold for other security-based swaps will be $150 million. Release No. 34-66868 will be published at ¶89,736.

Firm Not Liable for Failing to Predict Margin Calls. A 7th Circuit panel affirmed a district court judgment finding that a complaint failed to meet the statutory standard for demonstrating fraud. The action was brought by an investor who alleged that executives at a residential mortgage insurer made false and misleading statements intended to conceal the impact of the subprime mortgage crisis on the insurer’s business. Only one of the original plaintiffs filed a notice of appeal, and only one claim survived to the appellate briefs.

On appeal, the sole claim was that fraud occurred in connection with a press release and statements made during one of the insurer’s quarterly earnings calls. The statements concerned a company that packaged and sold subprime residential mortgage loans. The insurer owned forty-six percent of the company’s equity units, and as the subprime market began to collapse, the company lost its ability to meet margin calls, which affected its viability and the value of the securities that the insurer owned. The insurer’s press release stated that the company had “substantial liquidity,” and the investor argued that this statement was false because there were signs that the company’s reserves would not last long and because the insurer later declared its investment in the company to be “materially impaired.”

The panel agreed with the district court’s finding that the “substantial liquidity” statement was true. According to the panel, the company had depleted its reserves by $150 million in six months of meeting margin calls, and still had $150 million remaining. This, the panel remarked, was a substantial amount of money both in absolute terms and in relation to the needs of the business. This also meant, the panel continued, that the complaint failed to plead scienter since the remaining reserves could be described as “substantial” without demonstrating bad intent. Moreover, the statement at issue contained a warning that the reserves might be insufficient that specifically addressed the problems faced by participants in the subprime market at the time.

Next, between the time of the earnings call and the date on which the insurer declared the material impairment, the company received an additional $470 million in margin calls, which were met with a combination of internally generated cash and additional investments. The panel concluded that the most the allegation could support was the proposition that the insurer should have seen the problem, which is negligence rather than fraud. The panel explained that if the insurer had seen the looming problem, it would have stopped contributing capital to the company; the insurer instead believed that the company would survive and backed its belief with its contributions. The panel observed that at the time, the fact that the market was slumping did not necessarily imply a collapse. “The crisis took many experts by surprise,” wrote the panel, and for every seller, there was a buyer who expected the market to go back up. The press release accordingly did not misrepresent the past or the current condition of the company, and the insurer “had no duty to foresee the future,” the panel stated.

Finally, the investor sought to hold the insurer vicariously liable for statements in the press release made by two of the company’s officers. The investor argued that the insurer had control over the company due to its 46 percent interest in it. The panel pointed out, however that a third party owned another 46 percent of the shares, which was intended to prevent either from having unilateral control. The investor also did not argue that the insurer directed the officers to say what they did. Accordingly, the insurer was not liable as a controlling person. The officers also had ultimate authority over their statements, so the insurer could not be treated as their maker. Direct claims against the officers because neither they nor the insurer, as the panel concluded, could be “ liable under the federal securities laws for failing to foresee what was to happen during the next two weeks.” Fulton County Employees’ Retirement System v. MGIC Investment Corporation (7thCir) is reported at ¶96,798.

Shareholders Failed to Meet Gartenberg Standard on Advisory Fees. An 8th Circuit panel reconsidered whether mutual fund shareholders set forth sufficient evidence to survive summary judgment on their claim that the funds’ advisers breached the fiduciary duty imposed by Investment Company Act Section 36(b), and concluded that the shareholders failed to meet their burden. The shareholders in nine mutual funds managed by the defendants brought the action alleging that the advisers breached their fiduciary duty with respect to the receipt of compensation for services by misleading the funds’ board of directors during fee negotiations and demanding excessive fees. The shareholders argued that the advisers purposefully omitted, disguised, or obfuscated information concerning fee discrepancies between mutual funds and comparable services provided for institutional accounts.

The appellate court had earlier reversed a district court decision in this action granting summary judgment in favor of the advisers based on an analysis of whether the fee was so large that it could not have been the product of arm’s-length bargaining according to factors set forth in Gartenberg v. Merrill Lynch Asset Mgmt., Inc. The appellate court concluded that excessive fees were not the only way in which a fund adviser can breach its fiduciary duties and remanded with instructions to also consider both the advisers’ conduct during negotiation and the end result. While the appeal was pending, the U.S. Supreme Court decided Jones v. Harris Associates L.P., which considered what a shareholder must prove to show a breach of the fiduciary duty under Section 36(b). The Supreme Court subsequently vacated and remanded the panel’s opinion in this case, which, in turn was remanded to the district court, which reinstated its earlier opinion.

In light of the U.S. Supreme Court’s decision in Jones, the panel affirmed the district court’s grant of summary judgment in favor of the funds. In Jones, the Supreme Court affirmed the use of the Gartenberg approach for assessing the fiduciary duty under Section 36(b) of the Investment Company Act with regard to investment adviser compensation. To face liability under Section 36(b), an investment adviser must charge a fee that is so disproportionately large that it bears no reasonable relationship to the services rendered and could not have been the product of arm’s-length bargaining. The panel concluded that the shareholders failed to meet this burden.

The panel remarked that post-Jones the question is whether the fees themselves were excessive. According to the panel, the fee negotiation process “remains crucially important, as it allows the court to determine the amount of deference to give the board’s decision to approve the fee.” In this case, the panel had previously fully considered the fee negotiation process and found it to be “robust.” The panel then found that the shareholders failed to show evidence sufficient to survive summary judgment that the advisers charged excessive fees to mutual fund clients. The panel had earlier agreed with the district court’s conclusion that the evidence failed to meet the Gartenberg standard and determined that Jones did not require that these arguments be revisited. Further arguments by the shareholders failed because they failed to set forth additional evidence showing that the fees were outside the arm’s-length range. The panel concluded that the district court’s initial review of the other relevant circumstances and the disputed fees themselves was sufficiently detailed to constitute a “rigorous look at the outcome” under Jones. Gallus v. Ameriprise Financial, Inc. (8thCir) is reported at ¶96,776.

Market Manipulation Not Shown in ARS Case. The 2nd Circuit found in a summary order that a purchaser of auction-rate securities failed to state a manipulation claim against Citigroup. The market was not misled, concluded the court, because the transactions’ terms were adequately disclosed.

The core allegation in the complaint was that the plaintiffs purchased Citigroup auction-rate securities based on their belief that auction clearing rates were determined solely by investor supply and demand when, in fact, the defendants were increasingly intervening in the ARS market without the plaintiffs’ knowledge. However, the claims were not actionable in light of Citigroup’s disclosures that “in its sole discretion” it could routinely place one or more bids in an auction for its own account to prevent a failed auction. The disclosures noted that “bids by Citigroup...are likely to affect (i) the auction rate...and (ii) the allocation of ARS being auctioned.”

Accordingly, the court found that the plaintiffs could not plausibly allege that Citigroup was intervening in the ARS market without their knowledge or that they reasonably believed that auction clearing rates were determined by “the natural interplay of supply and demand.” The court also rejected the purchasers’ arguments that notwithstanding the disclosures, the conduct was misleading due to the increasing frequency with which Citigroup placed support bids. However, the Citigroup statement that it “may routinely” place support bids precluded recovery on the claims. Finn v. Smith Barney (SD NY) is reported at ¶96,774.

CCH Blue Sky Law Reporter

California Extends De Minimis Exemption. The California de minimis exemption for investment advisers who do not hold themselves out generally to the public as investment advisers and have had fewer than 15 clients during the preceding 12 months was extended by emergency from April 17 to July 16, 2012. During this time period, the California Department of Corporations will be reviewing the comments received on its proposed private fund adviser exemption to prepare that proposed rule for final adoption. NOTE: Adoption of the private fund adviser exemption will repeal the de minimis exemption. ¶12,167D.

Colorado Adopts Private Fund Adviser Exemption. Colorado’s private fund adviser exemption applies to: (1) a “family office” as defined in Rule 202(a)(11)(G)-1 of the Investment Advisers Act of 1940 (“Advisers Act”); (2) a “foreign private adviser” as defined in Section 202(a)(3) and Rule 202(a)(30)-1 of the Advisers Act; and (3) investment advisers falling within the venture capital fund exemption at Section 203(l) of the Advisers Act who comply with the SEC Rule 204-4 reporting requirements, although advisers relying on this state licensing exemption are not required to file the SEC Rule 204-4 reports with the Colorado Securities Commissioner. Colorado incorporates by reference into the state licensing exemption the “grandfathering” provision from Rule 203(l)-1(b) in the Advisers Act. Investment adviser representatives are exempt from Colorado licensing requirements if their employing/associating investment advisers are exempt from licensing under the private fund adviser exemption. The exemption is unavailable for advisers subject to the “bad boy” disqualification provisions of Rule 262 of federal Regulation A. ¶13,672.

Georgia Clarifies Recently Adopted Securities Rules…Clarifications to some of the rules adopted on December 8, 2011 to conform them to the Georgia Uniform Securities Act of 2008 were, themselves, adopted by the Georgia Office of the Secretary of State. Modifications were made to the nonprofit organization securities exemption at ¶18,419, the Limited offering exemption for Rule 505 offerings at ¶18,415, the Invest Georgia exemption at ¶18,420, the electronic filing with designated entity and application renewal for investment advisers and investment adviser representatives at ¶18,434 and ¶18,441, the contract, exam, recordkeeping and supervision requirements for investment advisers at ¶18,442, ¶18,447, ¶18,448 and ¶18,450, and typographical errors were corrected in investment adviser applications and abandoned application rules at ¶18,434 and ¶18,441.

…And Makes Small Issuer Registrations under 1973 Securities Act Qualification Registrations under 2008 Uniform Securities Act. The Georgia Uniform Securities Act of 2008 (2008 Act), unlike the previous Georgia Securities Act of 1973 (1973 Act), does not have a registration provision for small issuers, and so the Securities Commissioner, by administrative order effective March 15, 2012, declared that small issuer registrations not having expired as of December 8, 2011 will be treated as registrations by qualification under the 2008 Act when they expire. Upon expiration, small issuers may renew their registrations by qualification, by sending the Securities Commissioner an updated prospectus under Georgia securities rule 590-4-3-.11 [on registration statement renewals] that complies with rule 590-4-3-.06(3)(c)(2) [on prospectus contents and delivery]. Filings made in accordance with this administrative order must be made within 30 days of the order’s effective date (March 15, 2012) or within 30 days from the anniversary of the effective date of the registration statement being renewed. Note that registration statements renewed in accordance with this administrative order will be subject to the Georgia Uniform Securities Act of 2008 and corresponding securities rules as if the original registration statements were filed under the 2008 Act rather than under the 1973 Act. ¶18,547.

Iowa Sets Forth Time-Table for Adviser Switch Process. The time-table for SEC registered investment advisers to switch to state registration was set forth by the Iowa Securities Bureau. Investment advisers must, by March 30, 2012, file an amendment with the SEC updating their amount of assets under management, and then, as soon as possible, apply for registration with each state they are required to register with and, finally, by June 28, 2012, file a partial Form ADV-W to withdraw from SEC registration. ¶25,565.

Kansas Allows Continuation of De Minimis Exemption for Advisers. The de mimimis exemption under former Section 203(b)(3) of the Investment Advisers Act of 1940 may continue to be claimed by investment advisers transacting business in Kansas who were or would be exempt from SEC registration before July 11, 2011, thereby exempting them from Kansas licensing requirements. To qualify for the extended exemption, investment advisers must have had less than 15 clients during the preceding 12 months, continue to have less than 15 clients, and neither hold themselves out generally to the public as investment advisers nor act (or will act) as investment advisers to any federally registered investment company under the Investment Company Act of 1940, or to a company that elected to be a business development company under Section 54 of the 1940 Act that did not withdraw its election. Investment adviser representatives acting for exempt investment advisers are, themselves, exempt from licensing requirements. NOTE: This order supersedes Kansas Interpretive Order 2000-003 from November 4, 2008 and Kansas Special Order 12E001 from July 19 2011. This order will be vacated when permanent regulations such as a private fund adviser exemption are adopted. ¶26,646.

Missouri Releases Time-Table for SEC Adviser Switch to State Registration. The time-table for SEC-registered investment advisers with $100 million or less in assets under management (“mid-size advisers”) to report their amount of assets under management to the SEC on a Form ADV amendment and then begin the state registration process was issued by the Missouri Securities Division on March 23, 2012. The Division conducts a pre-registration examination requiring mid-size advisers to timely correct the deficiencies found in their applications, to become registered in Missouri by June 28, 2012, the date all mid-size advisers must be withdrawn from SEC registration. Since Missouri’s pre-registration examination may be lengthy because of the approximate 120 applicants going through this process, the Securities Division encourages applicants to apply for state registration immediately after filing their Form ADV amendment with the SEC (by March 30, 2012). ¶35,600F.

Rhode Island Proposes Exemption for Private Fund Advisers. An exemption from investment adviser registration was proposed for private fund advisers by the Rhode Island Division of Securities. A public hearing on the proposed rule was held on April 19, 2012 at 10:00 a.m. at 1511 Pontiac Avenue, Cranston, Rhode Island 02920. ¶50,400A.

Washington State Proposes Mortgage Paper Securities Amendments. Rules providing an optional method for registering mortgage paper securities were proposed for amendment by the Washington Department of Financial Institutions. The rules as amended would strengthen investor suitability requirements, revise the calculation of the number of investors that may participate in a loan, establish requirements for participation agreements, revise net worth and bonding requirements, revise provisions regarding escrow accounts and escrow agreements, establish requirements for servicing agreements, codify the requirement for a disclaimer in advertisements, clarify the fiduciary duties of a mortgage broker-dealer, include additional dishonest and unethical practices, clarify the requirements for appraisals, clarify investors’ rights to receive information and access records concerning their investments, and update recordkeeping requirements. ¶61,701A - ¶61,704E.

SLUSA Did Not Preclude Claims Only “Tangentially Related” to Transactions in Covered Securities. Reversing the opinion of the district court in Roland v. Green, the federal Fifth Circuit Court of Appeals has held that the Securities Litigation Uniform Standards Act of 1998 (SLUSA) did not preclude claims for violations of the Texas and Louisiana Blue Sky Laws because the purchase or sale of covered securities was only “tangentially related to the fraudulent scheme alleged by the plaintiffs. Under SLUSA, no covered class action based upon the statutory or common law of any state may be maintained in any state or federal court by any private party alleging a misrepresentation or omission of a material fact “in connection with the purchase or sale of a covered security. Adopting the test employed by the Ninth Circuit, the Fifth Circuit panel held that a misrepresentation is made “in connection with the purchase or sale of securities under SLUSA if there is a relationship in which the fraud and the stock sale coincide or are “more than tangentially related.

The defendants had contended that, although the unregistered certificates of deposit purchased by the plaintiffs were not themselves covered securities, the purchases nevertheless satisfied the “in connection with requirement because the CDs were purportedly backed in part by investments in SLUSA-covered securities. The plaintiffs’ allegations regarding the fraud under Louisiana law were not more than tangentially related to transactions in covered securities, however, because the gravamen of the defendants’ allegedly fraudulent scheme consisted of representations to the plaintiffs that the CDs were liquid investments with consistently high rates of return and significant regulatory oversight, and not that the CDs were marketed with references to instruments in the underlying portfolio that might be SLUSA-covered securities. The aiding and abetting claims under Texas law which alleged that a law firm’s misrepresentations to the U.S. Securities and Exchange Commission permitted the scheme to continue operations were likewise only tangentially related to the transactions at issue. Accordingly, SLUSA did not preclude the plaintiffs from using state class actions to pursue their recovery. Roland v. Green is reported at ¶74,974.

Aspen Federal Securities Publications

Securities Regulation, by the late Louis Loss, Joel Seligman & Troy Paredes. The new Fourth Edition of Volumes VIII and XI (Index) of the cornerstone Securities Regulation treatise will soon be available online. This Fourth Edition volume fully incorporates the large number of relevant legislative, regulatory, and case law changes since Securities Regulation, Third Edition was published.

INSIGHTS: The Corporate & Securities Law Advisor, edited by Amy Goodman, of Gibson Dunn & Crutcher. The April 2012 issue, which marks the 25th Anniversary of this publication, is now available on IntelliConnect. Over the last 25 years, INSIGHTS: The Corporate & Securities Law Advisor, has served the corporate securities bar with consistent and authoritative analysis by noted experts. Topics in the April 2012 issue are: (1) changes in the regulation of securities offerings, (2) securities disclosure, (3) surviving a restatement, (4) director liability, (5) rights plans; and (6) the global perspective.

IPO Vital Signs

IPO Vital Signs, an advanced IPO research analysis tool, assists IPO professionals and pre-IPO companies satisfy their most challenging research needs and answers hundreds of mission critical questions for all the players in the IPO process. IPO Vital Signs’ tabular data analyses focus on issues surrounding client advisement, deal negotiation, and prospectus disclosure.

IPO Week in Review, a weekly e-newsletter to keep professionals up to date with recent filing and going public activity, is an important element of the IPO Vital Signs system or is available by separate subscription. Coverage includes a monthly feature article on recent trends in going public in the U.S.

To see how an IPO Vital Sign works click on the Vital Sign title below:

Free Preview!>> |

#1003 - The IPO Queue

|

Tip! Click on the column headings to re-sort the table in ascending order, pause and click again to sort in descending order.

Review prospective issuers’ business descriptions by

1. placing a check mark in the check boxes provided in column four for those prospective issuers you wish to review, and

2. clicking the [COMPARE] button located in the fifth column heading.

RBsource

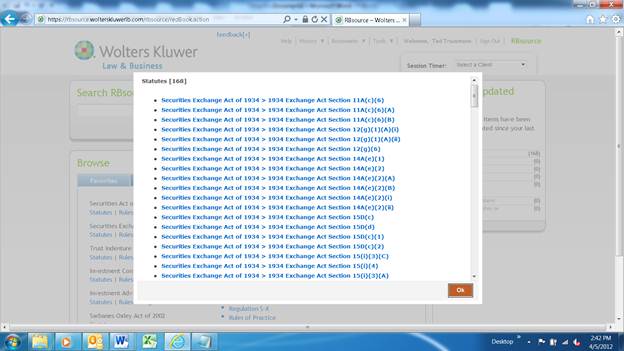

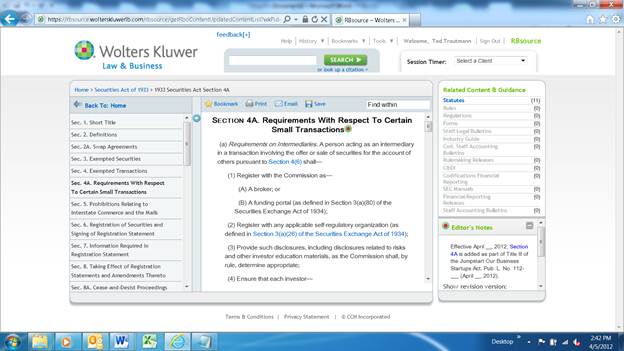

A new research tool powered by the Securities Redbook (Securities Act Handbook), RBsource offers you securities laws, rules, regulation and forms together with related SEC guidance and interpretations. With RBsource, you will have SEC guidance related to a specific law, regulation or rule at your fingertips without the need of further searching or browsing. RBsource uniquely associates related content, going beyond the limits of standard searching making research more streamlined and productive. This intuitive research tool will drastically reduce your research time and provide the unparalleled confidence expected from the trusted Securities Act Handbook.

Legislative Developments

The Stop Trading on Congressional Knowledge Act of 2012 (STOCK Act) and the Jumpstart Our Business Startups (JOBS) Act became law on April 4 and April 5 of 2012, respectively. RBSource updated the affected law sections within hours of each act being signed into law by the president.

- The STOCK Act clarifies that members of Congress and other federal officials are subject to the antifraud provisions of the securities laws. The law amended Exchange Act Section 21A to explicitly bring Congressional, executive, and judicial officials and employees within the scope of civil penalties for insider trading.

- The JOBS Act seeks to help smaller companies raise capital by creating a new type of entity and by amending the securities laws to create a modern IPO on ramp.

- Title I creates a new entity called an “emerging growth company” that will enjoy scaled disclosure and reporting obligations. These firms have an up to five year on ramp to an IPO if their total annual gross revenues are under $1 billion.

- Title II removes the ban on general solicitation or advertising under Regulation D and Rule 144A if buyers of securities are accredited investors or qualified institutional buyers, respectively.

- Title III permits crowdfunding of smaller companies while providing a limited exemption from broker-dealer registration for registered funding portals. Significantly, the crowdfunding title is unavailable to issuers until the SEC adopts implementing rules and regulations.

- Title IV promotes small company capital formation by increasing the Regulation A exemption from $5 million to $50 million.

- Title V raises the Exchange Act Section 12(g) shareholder cap to 2,000 (500 if not accredited investors). These provisions also exclude from the “held of record” calculation any shares acquired in Securities Act-exempt transactions in an employee compensation plan.

- Title VI raises the shareholder threshold for registration for banks and bank holding companies.

- Title VII requires the SEC to make information available online and to conduct outreach to small and medium sized companies, including women-, veteran-, and minority-owned firms.

RBSource subscribers had access to the amended securities laws and related editor’s notes within hours of each act becoming law. For example, the April 5, 2012 New & Updated Content feature indicated 168 law amendments. Users could link to a list of amended provisions with direct links to affected law text. The following screen captures show how subscribers could link to the JOBS Act crowdfunding requirements in new Securities Act Section 4A:

SEC Rulemaking Activity

- 34-66868—Further Definition of “Swap Dealer,” “Security-Based Swap Dealer,” “Major Swap Participant,” “Major Security-Based Swap Participant” and “Eligible Contract Participant."

These rules jointly adopted by the SEC and the Commodity Futures Trading Commission (CFTC), in consultation with the Fed, represent a major step toward full implementation of the OTC derivatives provisions set forth in Dodd-Frank Act Title VII. The SEC rules were unanimously adopted at an open meeting April 18, 2012. The joint rule release was issued April 27, 2012. Most provisions are effective 60 days after publication in the Federal Register, except for some CFTC rules and an interim rule.

- 33-9308—Exemptions for Security-Based Swaps Issued by Certain Clearing Agencies.

The rules exempt security-based swaps issued by certain clearing agencies that meet new regulatory criteria from the Securities Act (Section 17(a) antifraud provision still applies), the Exchange Act, and the Trust Indenture Act. The Commission issued the rules on March 30, 2012. The exemptions are effective April 16, 2012.

- 34-66839—Order Temporarily Exempting Broker-Dealers from the Recordkeeping, Reporting, and Monitoring Requirements of Rule 13h-1 under the Securities Exchange Act of 1934 and Granting an Exemption for Certain Securities Transactions.

The SEC has extended the temporary exemption for broker-dealers from the large trader reporting requirements. The exemption will allow more time for these firms to comply with the recordkeeping, reporting, and monitoring requirements of Exchange Act Rule 13h-1. The order extended the April 30, 2012 compliance date for registered broker-dealers to May 1, 2013. However, the compliance date is extended to only November 30, 2012 for broker-dealers that are large traders or have large trader customers that are either broker-dealers or that trade through a “sponsored access” arrangement. The order was issued April 20, 2012.

This month’s hot topic is shareholder proposals. A shareholder proposal is a shareholder’s recommendation that the company and/or its board of directors take an action, which the shareholder intends to present at a shareholder meeting. Exchange Act Rule 14a-8 dictates when a company must include shareholder proposals in its proxy materials issued before an annual or special shareholder meeting. A registrant that receives a shareholder proposal within the prescribed time before the solicitation must include the proposal in its proxy statement, identify the proposal in the form of proxy, and give recipients of the proxy material a means by which to vote on the proposal, if the proposing shareholder meets the eligibility conditions and if the proposal does not fall within any enumerated ground for exclusion.

Rule 14a-8 enumerates thirteen substantive grounds on which management may exclude proposals. Exclusion is proper, for example, if the proposal: would require the registrant to violate state, federal, or foreign law; concerns the election of directors; violates any of the SEC’s proxy rules, including the anti-fraud rule; concerns the redress of a personal claim or grievance against the company; or concerns matters that relate to the registrant’s ordinary business operations. The company has the burden of showing that it is entitled to exclude the proposal and must submit to both the SEC and the proponent copies of the proposal, an explanation of the reasons why the company believes that exclusion is proper and a supporting opinion of counsel, in the case of grounds based on state or foreign law. A company that includes a shareholder proposal in its proxy materials may elect also to include a statement opposing the proposal.

There are also procedural and eligibility grounds on which a company may rely to exclude proposals. At the time a proposal is submitted, the proponent must demonstrate his or her eligibility. A proponent must be a record or beneficial owner of at least one percent or $2,000 in market value of securities entitled to be voted at the meeting on the proposal. Additionally, the proponent must have held the securities for at least one year before submission and must continue to hold those securities through the date of the meeting. A shareholder may submit only one proposal to a company for a given shareholder meeting, and the proposal and any supporting statement cannot exceed 500 words. Finally, the proponent, or a qualified representative must attend the meeting to present the proposal. If a proponent fails to comply with the above procedural or eligibility requirements, the company may exclude the proposal under Rule 14a-8(f).

We publish information in a wide range of resources (e.g., Federal Securities Law Reporter, SEC Today, Securities Regulation - Loss & Seligman, etc.), and document types (cases, laws, regulations, newsletter articles, treatise discussion). For example:

- Federal Securities Law Reporter

- Exchange Act Rule 14a-8, at ¶24,012

- No-Action Letters (e.g., Danaher Corp. at ¶76,919 and Charles Schwab Corp. at ¶76,930)

- CCH Explanations (e.g., ¶24,030.070 and ¶24,151.065)

- Report letters (e.g., 4-26-12, “Staff Advises on Excludability of Shareholder Proposals”)

- SEC Staff Legal Bulletin No. 14 at ¶60,014

- SEC Staff Legal Bulletin No. 14B at ¶60,014B

- SEC Today, SEC Issues Notice of Effective Date for Amendment to Rule 14a-8 (9-19-11)

- Insights – Amy L. Goodman (e.g., “Anticipating the First Wave of Proxy Access Shareholder Proposals” (October 2011)

- Securities Regulation – Loss, Seligman & Paredes (e.g., Chapter 6.C.4, Contested Solicitations and Security Holder Proposals)

- Regulation of Corporate Disclosure – Brown (e.g., §2.02[1][a])

- Regulation of Securities: SEC Answer Book – Levy (e.g., Q11:3, “How does the shareholder proposal process work in general?”

- Jim Hamilton’s World of Securities Regulation (www.jimhamiltonblog.blogspot.com)